University of New South Wales Faculty of Law Research Series

|

Home

| Databases

| WorldLII

| Search

| Feedback

University of New South Wales Faculty of Law Research Series |

|

Last Updated: 17 February 2011

The Financialisation of Agricultural Commodity Futures Trading and its Impact on the 2006-2008 Global Food Crisis

Nicola Colbran[1]

Citation

This paper was presented at the 3rd biennial Ingram Colloquium on International Law and Development held at the UNSW Law faculty on 2 December 2010.

What for a poor man is a crust, for a rich man is a securitised asset class.[2]

The strong and sustained increase in primary commodity prices between 2006-2008 was accompanied by a growing presence of institutional (index) investors on commodity futures exchanges. Concerns have been raised that the price rises and volatility that occurred during this period were in large part driven by the activities of these investors and their use of commodities as an asset class. The increase and volatility in food commodity prices during this period had a severe impact on food security throughout the world.[3] Prices soared,[4] and as a result of the crisis 75 million more people became under-nourished and food insecure.[5] It led to civil unrest in over 40 countries, and reactionary protectionist trade measures that only further exacerbated the crisis. The high cost of importing food hit the most vulnerable countries particularly hard. The food import bill of the 50 least developed countries in 2007 reached USD 17.9 billion (30% more than in 2006) and in 2008 reached USD 24.6 billion (37% more than in 2007). Higher food and fuel prices also led to substantial increases in headline inflation, particularly in emerging markets and low-income countries.[6] Governments concerned about the stability of food supplies began acquiring farmland in foreign, mostly developing, countries as an alternative to purchasing food from international markets. Investment houses, private equity funds, hedge funds also began buying up land.[7] This acquisition of farmland poses a threat to people’s livelihoods, alters existing land use patterns, commoditizes the land and threatens food security in the country where the land is acquired.

While the crisis has had extensive negative implications for human rights, its causes are complex and numerous. Market fundamentals (supply and demand) certainly played a role, and it has also been argued that a rise in oil prices which led to a rise in the price of transportation, pesticides and fertilizers; a rise in the demand for agrofuels; the depreciation of the US dollar; and small harvests due to weather-related events such as extended droughts and pest plagues, among other things, adversely affected prices. Speculative activity on commodity markets has also been identified as an exacerbating factor. While all these factors undoubtedly contributed to uncertainty and a level of volatility in the market, debate is fierce as to how much blame can or should be attributed to each.

The subject of this article is whether the financialisation of agricultural commodity futures trading contributed to the sudden price rises in 2006-2008.[8] It also discusses the effect of financialisation on the functioning and usefulness of futures markets, and considers whether speculation could exacerbate price volatility again. The article is not intended to be an overly technical analysis of the topic and therefore does not include detailed economic analyses or econometric modelling.[9] Rather, it seeks to provide an objective and straightforward discussion for those generally interested in agricultural commodity markets and their impact on food security and developing countries more generally.

Financialisation of the Markets

Futures markets have customarily been dominated by traditional hedgers (also known as commercial traders[10]) who want protection against price movements or fluctuations of particular commodities. Through futures contracts, traders commit to buying or selling a commodity at a future date at a pre-established price (the futures price). Hedgers transfer price risk to other agents that are prepared to assume this risk by selling forward. These agents make a gain or loss depending on the changes in the futures price. In addition to protecting against price risk, futures markets also facilitate price discovery, assisting farmers and buyers to discover a reasonable price for a particular commodity in individual trades and on the underlying spot (cash) market. The activities of hedgers convey information about market conditions in the spot markets, and about current and expected supply and demand conditions. Traditional speculation is based on market fundamentals, above all supply and demand, and participants have an interest in the underlying physical commodities.

Because it reduces price risk, hedging has also been considered an alternative to supply management under international commodity agreements, and as a tool to hedge against unpredictable changes in both import and export prices. In doing so, it makes export revenues and import bills more predictable. This can be beneficial to the extent that it allows proper planning of financial and other resources.[11] Some analysts even argue that commodity markets have come to assume a broader developmental role by removing or reducing the high transaction costs along the commodity supply chain.[12]

In recent years however, index speculation in futures markets has grown exponentially as commodities are increasingly viewed as an asset class, and not as a mechanism for managing the risk of producers and consumers.[13] Index speculators distribute their allocation of dollars across commodities futures according to indices such as the Standard & Poors – Goldman Sachs Commodity Index and the Dow Jones – Union Bank of Switzerland (UBS) Commodity Index.[14] They seek to balance risks from other investments, such as stocks, bonds and real estate,[15] and regard commodities as an investment alternative to these asset classes. They take positions in commodities as a group, based on their assessment of the risk-return properties of portfolios that contain a proportion of commodity futures relative to portfolios that contain only traditional asset classes.[16] Index funds generally only take long positions,[17] which they sell as expiry approaches and use the proceeds from the sale to buy forward again.[18] No physical ownership of commodities is involved,[19] and prices are not set solely according to factors of supply and demand.[20]

Index speculators are usually large powerful institutional investors such as hedge funds, pension funds and investment banks, all of which are generally unconcerned with agricultural market fundamentals such as supply and demand. They win gains on price changes through the use of derivatives. Derivatives are not based on an exchange of tangible assets such as goods or money, but are financial contracts with a value linked to the expected future price movements of the underlying asset.[21]

Entry into the market by institutional investors was in large part made possible by deregulation in the commodity derivatives markets in the 1990s-2000s. Huge potential for profit from commodity speculation instruments led to intense lobbying by institutions such as Goldman Sachs, which argued for more freedom and less regulatory oversight.[22] In particular, institutional investors argued that like traditional hedgers, they too as swap dealers were using futures to hedge their risk against changes in commodity prices.[23] They should therefore be treated the same way as traditional hedgers and not have position limits (limits on number of contracts they can hold at the one time). However, contrary to traditional commercial traders who hedge physical positions, swap dealers hedge financial positions.

In 2000, the Commodity Futures Modernization Act was passed. This Act, together with related decisions by the US CFTC (Commodity Futures Trading Commission),[24] allowed the trading of derivatives over-the-counter (OTC) through swap agreements without position limits, disclosure requirements, or regulatory oversight.[25] The Act also permitted OTC derivatives where neither party was hedging against a pre-existing risk (ie. both parties were speculating). In 2004, investment banks were further exempted from the requirement to keep large enough currency reserves to cover unsuccessful trades. [26] This latter exemption allowed banks to more freely invest in high-risk investments, including index speculation.

At the same time, the amount invested in the OTC derivatives markets exploded. A study by Lehman Brothers in 2008 revealed that the volume of index fund speculation increased by 1,900% between 2003 and March 2008, while Morgan Stanley estimated that the number of outstanding contracts in maize futures increased from 500,000 in 2003 to almost 2.5 million in 2008. [27] By December 2008, the overall value of derivative markets worldwide was estimated to be USD 517.8 trillion.[28]

The effect of index speculation on price volatility and the effective functioning of the futures markets, particularly during the 2006-2008 global food crisis, has polarised opinion. At the heart of the debate is how much speculation has increased food prices beyond what can be accounted for by traditional market fundamentals of supply and demand. Those who deny speculation played any role at all essentially argue that supply and demand accounted for the price volatility during the crisis, and that futures merely form the mechanism by which information about fundamentals is incorporated into market prices. Examples of this point of view are cited in a 2010 report by the World Bank, and include a series of New York Times blogs by Krugman which reject not only the idea that speculation fuelled the boom, but also any suggestion that commodity trading in futures exchanges had any effect on commodity prices at all. An IOSCO (International Organization of Securities Commissions) Task Force, formed by the G-8 to examine the issue of speculation in commodity markets, also found that economic fundamentals, not speculation, was the possible explanation for price changes in commodities during the period.[29]

Taking a more neutral view on the issue is a US academic review of two dozen studies on causes of the price increases, conducted in July 2008, which stated that it was impossible to tell whether speculation played a role.[30]

On the other hand, there are those who believe speculation has increased food prices beyond what can be accounted for by traditional market fundamentals. At his US congressional testimony, George Soros called commodity index trading intellectually unsound, potentially destabilising and distinctly harmful in its economic consequences. The Special Rapporteur on the Right to Food, paraphrasing a 2009 report by the United National Conference on Trade and Development (UNCTAD), stated that “the changes in food prices reflected not so much movements in the supply and/or demand of food, but were driven to a significant extent by speculation...”[31] On the basis of empirical evidence, Gilbert has also concluded that “[b]y investing across the entire range of commodity futures, index-based investors appear to have inflated commodity prices,” and Robles identified speculative activity in the futures market as a source of the 2006-2008 price increases.[32]

One challenge to several views expressed above is that they are based on official data collected by the CFTC. The data held by the CFTC is somewhat ‘contaminated’ because, as mentioned above, many swap dealers are classified as commercial traders in the same way as traditional hedgers, even though they are hedging risk associated with derivative positions and not risk associated with the actual physical commodity. The analyses therefore are limited by the quantity and quality of CFTC reported data.[33] The Chicago Board of Trade, the oldest and one of the most significant futures and options exchanges, also commented on this problem, suggesting that treating index speculators in the same way as traditional hedgers “may have placed all market participants at a disadvantage with respect to the usefulness of the information [provided in the Commitments of Traders (COT) reports published by the CFTC]”.[34]

Another point of view, and one that will be elaborated on further in this article, is that while developments affecting supply and demand may have triggered the price rises and volatility, excessive and insufficiently regulated speculation exacerbated the problem, and increased the risks it posed. The UN Food and Agriculture Organization (FAO) has explained it in this manner:

...[t]he wider and more unpredictable the price changes in a commodity are, the greater is the possibility of realizing large gains by speculating on future price movements of that commodity. Thus, volatility can attract significant speculative activity, which in turn can initiate a vicious cycle

of destabilizing cash prices.[35]

There are a number of reasons why it can be argued that the financialisation of agricultural commodities futures trading exacerbated the crisis and increased the risks posed by high prices. Firstly, while supply and demand was tight during the crisis, market fundamentals cannot solely account for the massive rise in agricultural commodities prices during 2006-2008. According to the FAO, as of March 2008 volatility in wheat prices reached 60% beyond what could be explained by supply and demand factors.[36] Prices for a number of commodities also fluctuated too wildly within a limited time-frame for such price behaviour to have been a result of movements in supply and demand. Wheat prices, for instance, rose by 46% between 10 January and 26 February 2008, fell back almost completely by 19 May and increased again by 21% until early June and began falling again from August.[37]

Secondly, the fact that prices increased and subsequently declined across all major categories of commodities also indicates that fundamental supply and demand relationships alone did not cause these movements.[38] Index speculators do not trade on the basis of market fundamentals such as supply and demand, but rather distribute their allocation of dollars across commodities futures according to indices, seeking to balance risks from other investments such as stocks, bonds and real estate. They take positions in commodities as a group, based on their assessment of the risk-return properties of portfolios that contain a proportion of commodity futures relative to portfolios that contain only traditional asset classes.[39] As a result, index-based investment generates price pressure in the same direction across a broad range of commodities. The UN Commission of Experts on Reforms of the International Monetary System, led by Joseph Stiglitz, commented that “in the period before the outbreak of the crisis, inflation spread from financial asset prices to petroleum, food, and other commodities, partly as a result of their becoming financial asset classes subject to financial investment and speculation.”[40] Gilbert confirms this, stating:

[s]ince [index] investors tend to look at the likely returns to commodities as a class, and not at likely returns on specific markets, their activities may tend to transmit upward (or downward) movements in one market across the entire range of commodity futures markets. This is likely to result in upward pressure in the less liquid agricultural markets and to increased price correlations across markets. It may have also transmitted upward price movements in energy and metals markets into the agricultural commodities.[41]

Thirdly, the fact that index speculators do not trade on the basis of supply and demand, and that they hold very large positions in commodity markets further implies that they can exert considerable influence on commodity price developments.[42] On its own, unexpected futures trading volume can cause cash price volatility for most commodities.[43] Yang, Balyeat and Leatham have used Granger causality tests and generalised forecast error variance decompositions to show indicatively that an unexpected increase in futures trading volume unidirectionally causes an increase in cash price volatility for most commodities.[44] The increasing demand for derivatives by speculators and dealers also reduced liquidity on the market and contributed to the price rises of futures contracts. [45] Such speculators tend to reduce liquidity by taking passive large positions, meaning that they leave their portfolio of securities unchanged for a considerable period of time.[46] According to one analyst, their behaviour amounts to “virtual hoarding via the futures market.”[47]

Fourthly, index speculators trade based on partial and uncertain data which means that traditional mechanisms – efficient absorption of information and physical adjustment of markets – that normally prevent prices from moving away from levels determined by fundamental supply and demand factors become weak, at least in the short term. This heightens the risk of speculative bubbles occurring.[48]

Partial and uncertain data (as well as uncertain supply and demand conditions) also lead other traders to focus on a small number of signals, causing to copy-cat behaviour or simple misinterpretation of the short term price effects resulting from changes in index traders’ positions. This may happen where traders rely on information about current market fundamentals and on forecasts of future market conditions, or where they consider past price movements as a guide to future developments. It is difficult for such traders to identify whether price changes were caused by genuine price signals or not. However, once they incorporate the signals into their own trading strategy, they perpetuate the validity of the signals as genuine price information.[49] As a 2009 report by UNCTAD further explains:

Noise traders (which include index speculators) change their total positions in commodities based on information relating to other asset markets but which has no relevance for commodity markets. They also tend to change the composition of their positions in commodities in response to different price changes for different commodities with a view to maintaining a specific commodity’s pre-determined weight in a commodity index. This makes it difficult for other traders to judge whether market prices are changing because of the position changes of noise traders or as a response to new information about market fundamentals.[50]

Exacerbating the impact of speculation on prices during this period was the lack of sufficient regulatory oversight of OTC derivative contracts. It meant that regulatory authorities could not identify undue concentrations of positions, evaluate the overall composition of the market or assess its functioning. They were also unable to cooperate with regulatory authorities in other countries for the purposes of efficiently managing and overseeing futures markets globally. The absence of disclosure and reporting requirements also meant that market participants themselves had limited information about trades through derivative contracts, and as a result, contracts had the potential to be manipulated, with prices being either too low or too high.

Trading derivatives away from futures exchanges also meant that non payment was possible, as risks associated with transactions fall to the swap dealer, unlike when trading occurs through exchanges. Lehman Brothers for example was party to 134,000 derivative contracts of all kinds without sufficient collateral just before it collapsed in September 2008.[51]

Impact of Price Volatility on the Markets

Price volatility became so extreme in 2006-2008 that traditional hedgers could no longer afford to use the market to hedge risks effectively. Hedging became more expensive as they could no longer finance margin calls triggered by sharp price increases.[52] For example, from January 2003-December 2008, margin levels as a proportion of contract value increased by 142% in maize, 79% in wheat and 175% in soybean on the Chicago Board of Trade.[53] Such unaffordability could itself reduce market liquidity and add to volatility. The Kansas City Board of Trade did point to a reduction in long-term hedging by traditional (commercial) hedgers at the beginning of 2008 as a result of higher market volatility.[54]

The volatility also meant that futures prices and spot (cash) market prices no longer converged as the date for a contract’s execution approached. When futures and cash prices for commodities do not converge, futures contracts do not provide an effective hedge against price risks. Futures prices have typically helped commodities traders to set a benchmark price in the underlying spot (cash) market.[55] With convergence came some degree of contract predictability which was needed to calculate when to buy or sell. As prices became more volatile and convergence less predictable, the futures market lost its price discovery and risk management functions for many market participants.

The gap between futures prices and spot prices also lead to what several analysts called ‘over-regulation’, and some commodity exchanges in Asia and Africa halted grain futures trading altogether. India for example de-listed four commodities (wheat, rice, urad and tur) for futures trading towards the end of financial year 2006-2007 because of accusations that speculative activity led to unusual price movements and contributed to the increase of commodity prices.[56]

The uncertainty caused by the high volatility also complicated decision-making for buyers and sellers. Greater uncertainty limits opportunities for producers to access credit markets and tends to result in the adoption of low-risk production at the expense of innovation and entrepreneurship.[57] The loss of price discovery and risk management functions also impacts on the usefulness of futures prices in setting the international reference prices that developing countries use in outlook studies that help set agricultural policy and allocate state resources to agriculture.[58] The FAO has stated:

‘[a]t the national level, many developing countries are still highly dependent on primary commodities, either in their exports or imports. While sharp price spikes can be a temporary boon to an exporter’s economy, they can also heighten the cost of importing foodstuffs and agricultural inputs. At the same time, large fluctuations in prices can have a destabilizing effect on real exchange rates of countries, putting a severe strain on their economy and hampering their efforts to reduce poverty.’[59]

Fall of Prices

The second half of 2008 saw a rapid fall in international food prices as oil prices tumbled and the financial crisis and global recession reduced demand. However, while international food prices fell, many of the adverse supply and market conditions remained unchanged. In the immediate period, supplies did not increase substantially and stocks remained low. The fall in prices was not caused by any widespread expansion in food availability, and in most developing countries, there was no positive supply response to high food prices. In 2007 the response was limited, and in 2008 it was almost non-existent. Cereal production for example increased in developing countries by less than 1% in 2008 and production actually decreased in the vast majority of these countries.[60]

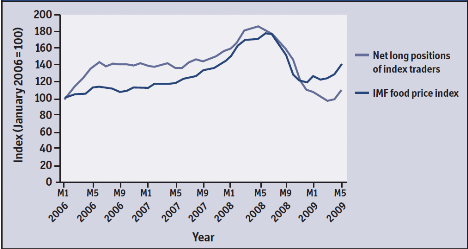

This rapid fall in agricultural commodity prices was preceded by a fall in the number of contracts held by index speculators. The Special Rapporteur on the Right to Food has drawn a connection between the two events, stating that the food price bubble burst when index speculators “lost the ability to carry on, as a result of their investments in other markets crashing. When they fell, the upward food price spiral also ended.”[61]

Graph 1: Index of estimated net long positions of index traders and IMF food price index (January 2006-May 2009)[62]

Yet, in spite of the sharp decline in prices across most commodity sectors in mid-late 2008, the main price indices are now twice as high compared to their 2000 levels. Stocks of key food commodities have also risen, and are 20% higher in 2009-2010 compared to 2007-2008, although the nominal food price index averaged 23% higher in December 2009 compared to December 2008. This is surprising given that one of the reasons given for the price spikes in 2008 was low inventories (and therefore supply and demand).[63]

Meanwhile, the fundamental structure of global financial markets appears relatively unchanged since before the 2006-2008 crisis. As discussed below, limited reform is slowly taking place, but the markets are still subject to supply shocks. For example, in August 2010, wheat prices hit a record USD 7.18 a bushel after Russia banned wheat exports. According to the Financial Times, Russia did so at the request of Glencore, the largest global commodities trader. The ban enabled Glencore and other traders to re-price their relatively lower-price forward and futures contracts.[64] Ironically, in September 2010 Russian President Dmitry Medvedev ordered law enforcement agencies to prevent speculators from driving up food prices.[65]

Concluding Remarks and Action Going Forward

Soaring food prices and the 2006-2008 global food crisis are matters of international concern that require international action. Key staples such as wheat, maize, soybeans, cocoa and sugar are traded on global commodity exchanges across a number of jurisdictions. Transparent, efficiently functioning commodity futures exchanges can provide reliable price signals to producers and consumers of primary commodities and contribute to a stable environment for development. The question then is how can the functioning of these exchanges be improved to ensure that they do so?

Evidence indicates that the crisis was allowed to develop due to major regulatory flaws in the global financial system. These flaws facilitated pure speculation on food prices that exacerbated the impacts of supply and demand movements in food commodities. Reforming the system should therefore be seen as part of the agenda to achieve food security, particularly in poor net food importing countries.[66] A number of suggestions have been put forward as to how this might be achieved. In the derivatives context, most of these relate to closing the swap dealer loophole so that regulators can counter unwarranted impacts of OTC trades on commodity exchanges, particularly in regard to exceeding position limits. They also relate to improving collaboration among regulatory agencies to facilitate effective functioning of markets globally and making delivery on contracts or portions of contracts compulsory.

In July 2010, prompted by the effects of the global financial crisis, the Obama administration passed the Dodd-Frank Act,[67] part of which addresses reform in the derivatives markets. The global financial crisis exposed unregulated (OTC) swaps in particular as playing a central role in the crisis. For example, AIG received a USD 180 billion bail-out when its ineffectively regulated USD 2 trillion derivatives portfolio nearly “brought down the financial system.”[68]

Chair of the CFTC, Gary Gensler, has stated that the Dodd-Frank Act will implement critical reform of the derivatives market by increasing transparency and lowering risk. The Act requires swap dealers to come under comprehensive regulation,[69] moves the bulk of the swaps marketplace onto transparent trade facilities – either exchanges or swap execution facilities, and requires clearing of standardized swaps by regulated clearinghouses to lower risk in the marketplace.[70] It also allows the CFTC to establish limits on the aggregate number or amount of positions in certain circumstances. Adopting position limits and therefore capping the number of contacts that institutional investors can hold at any one time, is intended to reduced ‘excessive speculation’.[71] However, the Act leaves many of the details of the new framework to be determined by regulations to be adopted by the Securities and Exchange Commission, the CFTC and other financial regulators.

The Dodd-Frank Act also addresses the issue of international harmonisation. It requires the CFTC to consult and coordinate with foreign regulatory authorities to establish international standards on the regulation of swaps and swap entities.

Although the full impact of the Act is not yet clear, criticisms have already emerged. Several analysts argue that it does not go far enough, and that “if you have bullets flying from every direction, [banks] will just change their behaviour just by virtue of their survival.”[72] Others note that in any case, the banks will be regulated by “the same folks that missed the last bubble.”[73] Critics have also argued that it is impossible to measure what constitutes ‘excessive speculation’, pointing to numerous studies that have failed to find a link between speculation and prices.[74]

The European Union is also considering regulating OTC derivatives. At present it relies on voluntary self-regulation. The EU Commissioner for the Internal Market and Services, Michel Barnier advocates regulation, but faces considerable opposition from the United Kingdom, where the majority of OTC trading occurs. In line with EU thinking, French President Nicolas Sarkozy has indicated that a key theme of France’s Presidency of the G-20 in 2011 will be to seek coordinated regulation of commodity derivatives and greater transparency in commodity markets trading and pricing. Sarkozy has warned that without action, “we run the risk of food riots in the poorest countries and a very unfavourable effect on global economic growth.”[75] G-20 talks may also include issues relating to an obligation for commodity investors to trade through exchanges rather than through OTC transactions, as well as for better data sharing arrangements. The French Prime Minister, Francois Fillon, also indicated that one of France’s top G-20 priorities will be to find a collective response to excessive volatility in commodity prices.[76]

While reform is being considered and undertaken, the real question perhaps is whether it will be enough to bring about lasting cultural changes in an industry that profited so handsomely from financialisation of futures markets in the first place. If reform is to succeed, then it will need to ensure that investors keep “the greater good, and not just their own greed, firmly in their sights.”[77] But whether moral values and ethics can ever be regulated for is a very different story.

[1]

Nicola Colbran is the Director of AusAID’s Australia Indonesia Partnership

for Justice. The author would like to thank David

Clifford for his comments on

the final draft of this

article.

[2] Ann

Berg, former member of the Chicago Board of Trade and commodity futures expert,

quoted in J. Vidal, ‘Africa: Food Speculation

– ‘People Die

From Hunger While Banks Make a Killing on Food’, 25 January 2011,

www.allafrica.com

[3]

Food security exists when populations have access on an ongoing basis to

sufficient, safe and nutritious food to meet their daily

dietary needs and food

preferences for an active healthy life: World Food Summit,

1996

[4] Between

March 2007 and March 2008, the price of corn (maize) rose by 31%, that of rice

by 74%, that of soybean by 87%, and that of

wheat by 130%. Overall, the price

of food commodities on the international markets rose by 83% over the 36 months

to March 2008:

O. de Schutter ‘Background Note Analysis of the World Food

Crisis by the U.N. Special Rapporteur On The Right To Food, Olivier

de

Schutter’, 2 May 2008,

p.5

[5] The price

rises have a particularly dramatic effect on families in developing countries

which spend 60 to 80% of their budget on

food: O. de Schutter note 4,

p.6

[6] P.

Conceição and H. Marone ‘Characterizing the

21st Century First Commodity Boom: Drivers and

Impact’, United Nations Development Programme/Office of Development

Studies, New

York, October 2008,

p.46

[7] These

institutions have been doing so with assistance from agencies such as the World

Bank, its International Finance Corporation

and the European Bank for

Reconstruction and Development. These agencies actively advised government to

change land ownership laws

and policies so that foreign investors have more

incentives to put money into farmland abroad. According to the World Bank,

changing

land ownership laws is an integral target of the Bank’s USD1.2

billion package to deal with the food crisis in Africa: GRAIN

Briefing,

‘SEIZED! The 2008 land grab for food and financial security’,

October 2008, Barcelona, Spain

pp.7-8

[8] In this

article, the term ‘financialisation’ refers to investment in futures

markets through the activities of index

speculators.

[9]

Econometric modelling and tests do not give definitive proof, but they can be

helpful in indicating what is likely, on balance,

to have happened. For

example, Granger causality tests give a statistical probability that, over a

long enough period of time, changes

in one variable precedes changes in another.

For readers interested in more technical analyses, papers such as that written

by Yang,

Balyeat and Leatham, and also Gilbert provide such an analysis. See

Yang et al.,‘Futures Trading Activity and Commodity Cash

Price

Volatility’ Journal of Business Finance & Accounting, 32(1)

& 2, January/March 2005, 0306-686X and C. Gilbert, ‘Commodity

Speculation and Commodity Investment’, University

of Trento, Italy,

Discussion Paper No.20, 2008.

[10] Commercial

traders use futures markets to hedge an existing exposure, whereas

non-commercial traders do

not.

[11] FAO,

‘The State of Agricultural Commodity Markets: high food prices and the

food crisis – experiences and lessons learned’,

2009, pp.45-46,

www.fao.org

[12]

United Nations Conference on Trade and Development (UNCTAD) ‘The Global

Economic Crisis: Systemic Failures and Multilateral

Remedies’, United

Nations New York and Geneva, 2009,

p.36

[13] According

to one estimate, index investment has increased from USD 13 billion at the end

of 2003 to USD 260 billion by March 2008

in US commodity futures markets:

Testimony of Michael W. Masters, Managing Member/Portfolio Manager, Masters

Capital Management,

LLC, before the Committee on Homeland Security and

Governmental Affairs, United States Senate, 20 May

2008

[14] These

indices are composites of futures contracts on a broad range of commodities

traded on commodity

exchanges.

[15] It

has been asserted that the speculative bubble was created to recoup the

financial markets’ losses when the technological

and real estate bubbles

burst: Syrian Deputy Prime Minister for Economic Affairs, Abdullah al-Dardari

quoted in Q&A: ‘Speculation is Causing an Oil and Food Price

Bubble’, IPS News, 10 July 2008.

[16] United

Nations Conference on Trade and Development (UNCTAD), ‘Trade and

Development Report 2009. Chapter II: The Financialization

of Commodity

Markets’, United Nations, New York and Geneva, 2009,

p.54

[17] A long

position is one where the holder owns the contract and so profits from its price

rising. In contrast, a short position is

selling a contract which has been

borrowed from a third party, with the intention of buying it back in the future.

Short sellers

profit from a fall in

prices.

[18] By

contrast, traditional hedgers, such as grain traders, manage risk in different

commodities by investing ‘short’ to

drive their own raw materials

prices down (they move in and out of the futures market in response to supply

and demand developments).

[19] Many futures

contracts are settled in cash rather than through the delivery of the underlying

commodity. This facilitates investors

outside the commodity business to use

commodities to diversify their portfolio, thereby more closely linking futures

markets for

commodities with other financial

markets.

[20] The

FAO has observed that only 2% of futures contracts result in the delivery of the

underlying physical commodity: FAO ‘Price

Surges in Food Markets: How

Should Organized Futures Markets be Regulated?’ Policy Brief No.9,

Economic and Social Perspectives,

June 2010,

p.1

[21] World

Development Movement, ‘The Great Hunger Lottery. How banking speculation

causes food crises’, July 2010, p.4,

www.wdm.org.uk

[22]

Commodity speculation instruments are enormously profitable for traders. For

example, an estimated one third of all net income for

Goldman Sachs in 2008,

some USD 1.5 billion, came from commodities trades: A. Davis. ‘Top Traders

Still Expect the Cash’

Wall Street Journal,19 November 2008,

http://online.wsj.com

[23]

Under swap agreements, an index investor will enter a swap agreement with a

bank, which hedges its swap exposure through an offsetting

futures contact. 90%

of the index funds that go to commodity markets flow through swap dealers: P.

Conceição and H.

Marone, note 6,

p.29

[24] The CFTC

was established in 1974 as an independent agency to regulate commodity futures

and option markets in the United

States.

[25] The

Act undid the restrictions put in place by the Roosevelt administration

following the Wall Street crash in the 1930s. The Roosevelt

administration had

recognised the effect of speculation that was detached from physical production

on the actual prices of food,

and introduced regulations such as position

limits, which placed a limit on the amount of derivatives that can be traded in

a particular

market, and was intended to prevent excessive speculation on

agricultural commodities. This was done through the Securities Act

of 1933, the

Securities Exchange Act of 1934 and the Commodity Exchange Act of 1936: World

Development Movement, note 21,

p.8

[26] The chief

lobbier for the 2004 exemption was Goldman Sachs chair and chief executive Henry

Paulson, who in 2006 became Treasury Secretary

to the George W. Bush

administration. Paulson led the Bush Administration’s efforts in 2008 to

nationalise the cost of bad

loans made by financial institutions such as Goldman

Sachs. In late September 2008, Paulson, along with Federal Reserve Chair Ben

Bernanke, agreed to use USD 700 billion dollars to purchase the bad debt they

had

incurred.

[27]

O de Schutter, ‘Food Commodities Speculation and Food Price

Crises’, Briefing Note 02, September 2010, p.3

[28] According to

the value of the underlying assets on which the derivative contracts are based:

SOMO, ‘Financing Food: Financialisation

and Financial Actors in

Agriculture Commodity Markets’, SOMO Paper, April 2010,

p.5

[29] J. Baffes

and T. Haniotis, ‘Placing the 2006/08 Commodity Price Boom into

Perspective’,The World Bank Development Prospects

Group, Policy Research

Working Paper 5371, July 2010,

pp.7-8

[30] W.

Tyner et al., ‘What’s Driving Food Prices?’ Farm Foundation,

23 July 2008, pp.6,

26-27

[31] O de

Schutter, note 27,

p.3

[32] J. Baffes

and T. Haniotis, note 29,

pp.7-8

[33]

Institute for Agriculture and Trade Policy ‘Commodities Markets

Speculation: The Risk to Food Security and Agriculture’,

November 2008,

Minneapolis, Minnesota, p.8. Note, however, that the CFTC did begin to produce

a supplementary report on 12 commodities,

including wheat, maize and soybeans,

which distinguishes positions held by index

funds.

[34] COT

reports are weekly reports published by the CFTC showing aggregate trader

positions in certain futures and options markets.

CFTC, ‘Commission

Actions in Response to the “Comprehensive Review of the Commitments of

Traders Reporting Program”

(June 21, 2006)’, 5 December 2006, p.7

[35] FAO, note 11,

p.11

[36] FAO,

‘Volatility in Agricultural Commodities: An Update’, Food

Outlook, June 2008,

www.fao.org

[37] O.

de Schutter, note 27,

p.3

[38] UNCTAD,

note 16,

p.53

[39] UNCTAD,

note 16,

p.54

[40] J.

Stiglitz et al., ‘Report of the Commission of Experts of the President of

the United Nations General Assembly on Reforms

of the International Monetary and

Financial System’ United Nations New York, 21 September 2009,

www.un.org

[41] C.

Gilbert, ‘How to Understand High Food Prices’, University of Trento,

Italy, Discussion Paper No.23, 2008,

p.28

[42] UNCTAD,

note 16,

p.11

[43] C.

Gilbert, note 9,

p.18

[44] J. Yang

et al., note 9

[45]

Index speculators buy futures and then roll their positions by buying calendar

spreads. They do not sell and so consume liquidity.

Liquidity is a measure of

an asset’s ability to be sold without causing significant movement in

price and with minimum loss

of value. In other words, it is the probability

that the next trade is executed at a price equal to the

last.

[46] Note

that the ISDA (the International Swaps and Derivatives Association) argues that

index investor participation in the commodities

market should not be associated

with increased speculation and volatility as “... Index investments are

passive and predictable,

and should not by themselves increase market

volatility...”: CFTC, note 34,

p.4.

[47] Testimony

of Michael W. Masters, note 13

[48]

UNCTAD, note 16,

p.66

[49] UNCTAD,

note 16,

pp.60-61

[50]

UNCTAD, note 16,

p.61

[51] UNCTAD,

‘The Global and Economic Crisis’ (UNCTAD/GDS/2009/1, 2009),

www.observatoriodoagronegocio.com.br/page41/files/CTAD,

quoted in SOMO, note 28,

p.4

[52] UNCTAD,

note 12, p.35. A margin is

collateral that the holder of a financial instrument, such as a derivative, has

to deposit to cover some or all

of the credit risk of his or her counterparty.

When the margin posted in the margin account is below the minimum requirements,

the

broker or exchange issues a margin

call.

[53] Chicago

Mercantile Exchange Group (CME), ‘Fundamental Factors Affecting

Agricultural and Other Commodities’, 2009,

www.cmegroup.com

[54]

UNCTAD, note 12,

p.35

[55] Futures

prices are considered the best predictor of future spot prices, since futures

markets are expected to ‘process’

all available information about

current and expected supply and demand

conditions.

[56]

Ministry of Consumer Affairs, Food & Public Distribution, Government of

India ‘Report of The Expert Committee to Study

the Impact of Futures

Trading on Agricultural Commodity Prices’, 2008,

para.3.5

[57] FAO,

note 11,

p.11

[58] Institute

for Agriculture and Trade Policy, note 33,

p.10

[59] FAO, note

11,

p.11

[60] FAO, note

11, pp.23,

29

[61] O. de

Schutter, note 27, p.6

[62] Graph taken

from World Development Movement, note 21, p.11. Index trader positions are

taken from UNCTAD, note 16, and the IMF

food price index is from IMF, ‘Commodity Prices 1980-2009’, March

2010

[63] J. Baffes

and T. Haniotis, note 29,

p.5

[64] Einnews

‘Food Commodity Speculation Seen As Driving Up Prices; EU to Consider

Regulating Markets’, 17 November 2010,

www.pr-inside.com

[65]

Moscow Times, ‘Medvedev Warns Speculators After Food Price Rise’,

Reuters, 3 September 2010,

www.themoscowtimes.com

[66]

O. de Schutter, note 27,

p.6

[67] Dodd-Frank

Wall Street Reform and Consumer Protection Act, (Pub.L. 111-203, H.R. 4173).

Signed into law by President Obama on 21 July 2010. The derivatives regulation

provisions of the Act generally take effect 360

days after enactment, or if a

provision requires rulemaking, 60 days after publication of the final rule.

Title VII, or the Wall

Street Transparency and Accountability Act of 2010 (H.R.

4173 §701), concerns regulation of OTC swaps

markets.

[68] Gary

Gensler, Remarks before the Practising Law Institute’s 42nd Annual

Institute on Securities Regulation, New York, NY, 11

November 2010,

www.cftc.gov

[69]

For example, by requiring dealers to meet recordkeeping and reporting

requirements so that regulators can police the

markets.

[70] Gary

Gensler, note 68

[71]

Excessive speculation is defined as trading that results in ‘sudden or

unreasonable fluctuations or unwarranted changes in

the price’ of

commodities underlying futures transactions: Commodity Exchange Act,

s.4a

[72] Arthur

Levitt, former Chair of the US Securities and Exchange Commission and adviser to

Goldman Sachs, quoted in F. Guerrera et al.,

‘Financial regulation: A line

is drawn’, Financial Times, 30 June 2010,

www.ft.com

[73] Roy

Smith, a former banker at Goldman Sachs and lecturer in finance at New York

University, quoted in F. Guerrera et al., note 72.

[74]

N. Tait et al, ‘EU to Rein in Commodity Speculation’, Financial

Times, 20 September, 2010, www.ft.com

[75] K. Maley,

‘Sarkozy takes aim at speculators’, Business Spectator, 25

January 2011,

www.businessspeculator.com.au

[76]

E. Jarry, ‘Sarkozy takes G20 case to Obama as food prices soar’,

Reuters, 10 January

2010

[77] F.

Guerrera et al., note 72

AustLII:

Copyright Policy

|

Disclaimers

|

Privacy Policy

|

Feedback

URL: http://www.austlii.edu.au/au/journals/UNSWLRS/2011/14.html