Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts

Division 57 -- Tax exempt entities that become taxable

Table of Subdivisions

Guide to Division 57

57 - A Key concepts

57 - B Predecessors of the transition taxpayer

57 - C Time when income derived

57 - D Time when losses and outgoings incurred

57 - E Assets and liabilities

57 - F Superannuation deductions

57 - G Denial of certain deductions

57 - H Domestic losses

57 - J Capital allowances and certain other deductions

57 - K Balancing adjustments

57 - L Trading stock

57 - M Imputation

57 - N Division not applicable in respect of certain plant

57 - 1 What this Division is about

This Division is about the income tax treatment of a taxpayer whose income ceases to be wholly exempt. Broadly, income, outgoings, gains and losses are attributed to the periods before and after the loss of full exemption.

Subdivision 57 - A -- Key concepts

57 - 5 Entities to which this Division applies

If:

(a) at a particular time, all of the income of a taxpayer is wholly exempt from income tax; and

(b) immediately after that time, the taxpayer's income becomes to any extent assessable income;

then:

(c) the taxpayer is a transition taxpayer ; and

(d) the time when the taxpayer's income becomes to that extent assessable is the transition time ; and

(e) the year of income in which the transition time occurs is the transition year for the taxpayer.

Subdivision 57 - B -- Predecessors of the transition taxpayer

57 - 10 Activities of transition taxpayer's predecessor attributed to transition taxpayer

(1) If:

(a) at the transition time, the transition taxpayer performs particular functions or carries on particular activities; and

(b) during any period before the transition taxpayer first began to perform the functions or carry on the activities, an exempt government entity performed those same functions or carried on those same activities; and

(c) at the end of the period, responsibility for performing the functions or carrying on the activities was transferred, either directly or through one or more other exempt government entities, to the transition taxpayer;

this Division applies as if, during that period, anything done by or to the exempt government entity in performing those functions or carrying on those activities had instead been done by or to the transition taxpayer.

Note: As a result of this provision, the transition taxpayer may for example be able to deduct after the transition time, under Division 40 of the Income Tax Assessment Act 1997 as modified by Subdivision 57 - J of this Schedule, a portion of allowable capital expenditure incurred before the transition time by an exempt government entity whose functions were transferred to the transition taxpayer.

(2) An exempt government entity is:

(a) the Commonwealth, a State or a Territory; or

(b) an STB, within the meaning of Division 1AB of Part III, that is exempt from tax under that Division.

Subdivision 57 - C -- Time when income derived

57 - 15 Time when income derived

(1) To the extent that income derived by the transition taxpayer before the transition time is in respect of:

(a) services rendered; or

(b) goods provided; or

(c) the doing of any other thing;

at or after the transition time, the income is treated for the purposes of this Act as having been derived at the time the services were rendered, the goods were provided or the thing was done, as the case requires.

(2) To the extent that income derived by the transition taxpayer at or after the transition time is in respect of:

(a) services rendered; or

(b) goods provided; or

(c) the doing of any other thing;

before the transition time, the income is treated for the purposes of this Act as having been derived before that time.

Subdivision 57 - D -- Time when losses and outgoings incurred

57 - 20 Time when losses and outgoings incurred

(1) To the extent that a loss or outgoing (within the meaning of section 51 of this Act or section 8 - 1 of the Income Tax Assessment Act 1997 , as appropriate) incurred by the transition taxpayer before the transition time is in respect of:

(a) services rendered; or

(b) goods provided; or

(c) the doing of any other thing;

at or after the transition time, the loss or outgoing is treated for the purposes of this Act as having been incurred at the time the services were rendered, the goods were provided or the thing was done, as the case requires.

(2) To the extent that a loss or outgoing (within the meaning of section 51 of this Act or section 8 - 1 of the Income Tax Assessment Act 1997 , as appropriate) incurred by the transition taxpayer at or after the transition time is in respect of:

(a) services rendered; or

(b) goods provided; or

(c) the doing of any other thing;

before the transition time, the loss or outgoing is treated for the purposes of this Act as having been incurred before that time.

Subdivision 57 - E -- Assets and liabilities

57 - 25 Deemed disposal and re - acquisition of assets

(1) This section applies to:

(a) the disposal of an asset by the transition taxpayer after the transition time; and

(b) a CGT event that happens after the transition time in relation to an asset owned by the transition taxpayer;

where the transition taxpayer owned the asset at all times from the transition time until the disposal or the CGT event.

Deemed disposal and re - purchase

(2) Subject to subsection (5), in determining for the purposes of this Act (other than the excluded provisions mentioned in subsection (4)) whether an amount is included in, or allowable as a deduction from, the assessable income of the transition taxpayer in respect of the disposal, the transition taxpayer is taken:

(a) to have sold, immediately before the transition time, each of its assets; and

(b) to have purchased each of its assets again at the transition time for consideration equal to the asset's adjusted market value at the transition time.

(2A) For the purposes of Parts 3 - 1 and 3 - 3 of the Income Tax Assessment Act 1997 (about CGT), in determining whether the transition taxpayer makes a capital gain or capital loss from a CGT event that happens after the transition time in relation to an asset referred to in subsection (1), the cost base and reduced cost base of the asset (at the transition time) is its adjusted market value at that time.

(3) An asset's adjusted market value at the transition time is the asset's market value at that time:

(a) reduced by any amount of income received or receivable by the transition taxpayer in respect of the asset at or after the transition time that:

(i) because of subsection 57 - 15(2); or

(ii) because all of the income of the transition taxpayer was wholly exempt from income tax before the transition time;

is not included in the transition taxpayer's assessable income; and

(b) increased by any amount of income received or receivable by the transition taxpayer in respect of the asset before the transition time that:

(i) because of subsection 57 - 15(1); or

(ii) because the transition taxpayer's income ceased to be exempt from income tax at the transition time;

is included in the transition taxpayer's assessable income.

Note: If the asset is, or is part of, a Division 230 financial arrangement, section 57 - 32 may affect how the market value of the asset is worked out.

Excluded provisions

(4) For the purposes of subsection (2), the excluded provisions are:

(e) former Division 10B of Part III of this Act (about industrial property); and

(f) former Division 10BA of Part III of this Act (about Australian films); and

(ga) Division 40 of the Income Tax Assessment Act 1997 (about capital allowances); and

(i) Division 43 of the Income Tax Assessment Act 1997 (about deductions for capital works); and

(j) section 70 - 120 of the Income Tax Assessment Act 1997 (about deducting capital costs of acquiring trees);

(la) Division 373 of the Income Tax Assessment Act 1997 (about intellectual property).

Listed provisions not affected

(5) If the transition taxpayer:

(a) acquired an asset (whether before the transition time or otherwise) before the commencement of a provision listed in subsection (6); and

(b) after acquiring the asset, owned the asset at all times before the transition time;

the deemed acquisition of the asset under subsection (2) does not affect the operation of the listed provision.

Listed provisions

(6) The provisions are listed in the table below. Provisions of the Income Tax Assessment Act 1997 are identified in normal text. The other provisions, in bold , are provisions of the Income Tax Assessment Act 1936 .

Listed provisions | |

Item | Provision |

1 | section 26BB |

3 | section 70B |

4 | the former Division 3B of Part III |

5 | Division 16E of Part III |

6 | Subdivision 20 - A, so far as it applies to an amount that may be an assessable recoupment because a deduction has been allowed or is allowable under the former subsection 82Z(1) |

6A | Division 230 |

7 | Division 775 |

8 | Subdivision 20 - A, so far as it applies to an amount that may be an assessable recoupment because a deduction has been allowed or is allowable under section 775 - 30 |

(6A) For the purposes of the application of subsection (5) to the transition taxpayer, a provision covered by item 7 or 8 of the table in subsection (6) is taken to have commenced at the start of the taxpayer's applicable commencement date (within the meaning of Division 775 of the Income Tax Assessment Act 1997 ).

Note: For applicable commencement date , see section 775 - 155 of the Income Tax Assessment Act 1997 .

(6B) The rule in subsection (5) does not apply, and is taken never to have applied, to the transition taxpayer in relation to a provision covered by item 7 or 8 of the table in subsection (6) if the taxpayer makes an election under section 775 - 150 of the Income Tax Assessment Act 1997 .

Avoidance of doubt--debt write - off

(7) To avoid doubt, an effect of subsection (2) is that the sum of all allowable deductions (if any) in respect of the writing off as bad of the whole or part of a debt to which that subsection applies will not exceed the market value of the debt at the transition time.

Avoidance of doubt--disposal need not involve an alienation

(8) To avoid doubt, an asset may be disposed of for the purposes of this section whether or not the disposal involves alienating the asset.

57 - 30 Deemed cessation and re - assumption of liabilities

(1) Subject to subsection (3), for the purposes of determining a deduction allowable to, or an amount included in the assessable income of, the transition taxpayer after the transition time in respect of the satisfaction of a liability owed by the transition taxpayer immediately before the transition time, the transition taxpayer is taken:

(a) to have ceased immediately before the transition time to have any liabilities; and

(b) to have assumed each of its liabilities again at the transition time in return for consideration equal to the adjusted market value (see subsection (2)) at that time of the right or other asset, corresponding to the liability, that was held by the person to whom the liability was owed.

(2) The adjusted market value of the corresponding right or other asset is the market value of that right or asset at the transition time:

(a) reduced by any amount paid or that becomes payable by the transition taxpayer in respect of the liability at or after the transition time, where:

(i) because of subsection 57 - 20(2); or

(ii) because all of the transition taxpayer's income was wholly exempt from income tax before the transition time;

the amount is not an allowable deduction; and

(b) increased by any amount paid or that became payable by the transition taxpayer in respect of the liability before the transition time, where:

(i) because of subsection 57 - 20(1); or

(ii) because the transition taxpayer's income ceased to be exempt from income tax at the transition time;

the amount is an allowable deduction.

Note: If the liability is, or is part of, a Division 230 financial arrangement, section 57 - 32 may affect how the market value of the corresponding right or other asset is worked out.

(3) A provision listed in subsection (4) only applies to a liability of the transition taxpayer at the transition time if the liability first came into existence after the day on which Division 3B of Part III commenced.

(4) The provisions are listed in the table below. Provisions of the Income Tax Assessment Act 1997 are identified in normal text. The other provisions, in bold , are provisions of the Income Tax Assessment Act 1936 .

Listed provisions | |

Item | Provision |

1 | the former Division 3B of Part III |

2 | Subdivision 20 - A, so far as it applies to an amount that may be an assessable recoupment because a deduction has been allowed or is allowable under the former subsection 82Z(1) . |

(5) A provision listed in subsection (6) only applies to a liability of the transition taxpayer at the transition time if the taxpayer first assumed the liability on or after the taxpayer's applicable commencement date (within the meaning of Division 775 of the Income Tax Assessment Act 1997 ).

Note: For applicable commencement date , see section 775 - 155 of the Income Tax Assessment Act 1997 .

(6) The provisions are listed in the table below. Provisions of the Income Tax Assessment Act 1997 are identified in normal text.

Listed provisions | |

Item | Provision |

1 | Division 775 |

2 | Subdivision 20 - A, so far as it applies to an amount that may be an assessable recoupment because a deduction has been allowed or is allowable under section 775 - 30. |

(7) The rule in subsection (5) does not apply, and is taken never to have applied, to the transition taxpayer if the taxpayer makes an election under section 775 - 150 of the Income Tax Assessment Act 1997 .

57 - 32 Division 230 financial arrangements--market value of assets and rights

(1) This section applies in relation to an asset (the subject asset ) held by an entity (the holder ) if:

(a) the subject asset is:

(i) covered by subsection 57 - 25(1); or

(ii) a right, or other asset, corresponding to a liability covered by subsection 57 - 30(1); and

(b) the subject asset, or the corresponding liability for the subject asset, is or is part of a Division 230 financial arrangement at the transition time; and

(c) when the arrangement was entered into:

(i) the parties to the arrangement were not dealing at arm's length (within the meaning of the Income Tax Assessment Act 1997 ) in relation to the subject asset; or

(ii) if the subject asset gives rise to an interest that is not an equity interest in an entity--the return on the interest would reasonably be expected to be less than the benchmark rate of return (within the meaning of that Act) for the interest.

(2) For the purposes mentioned in subsection (3), assume at the transition time that the market value of the subject asset is the total amount (the initial amount ) of the financial benefits (within the meaning of the Income Tax Assessment Act 1997 ) that the holder provided in relation to the subject asset before the transition time:

(a) reduced by:

(i) repayments of principal made in relation to the subject asset before the transition time; and

(ii) the amount of any impairment (within the meaning of the accounting principles (within the meaning of that Act)) of the subject asset at the transition time; and

(b) increased by the amount of the cumulative amortisation (worked out using the effective interest method recognised by the accounting principles (within the meaning of that Act)) of any difference at the transition time between:

(i) the initial amount; and

(ii) the amount payable on the maturity of the subject asset.

(3) Subsection (2) has effect for the purposes of working out the subject asset's adjusted market value under section 57 - 25 or 57 - 30 for use when applying Division 230 of the Income Tax Assessment Act 1997 to the subject asset or the corresponding liability for the subject asset.

57 - 33 Division 230 financial arrangements--transition taxpayer's right to receive or obligation to provide payment

(1) This section applies in relation to the following:

(a) an asset covered by subsection 57 - 25(1) to which section 57 - 32 applies;

(b) the corresponding liability for a right, or other asset, covered by subsection 57 - 30(1) to which section 57 - 32 applies.

Note: Section 57 - 32 applies if the asset or liability is or is part of a Division 230 financial arrangement.

(2) For the purposes of section 230 - 60 of the Income Tax Assessment Act 1997 , assume the following:

(a) in the case of an asset--that the transition taxpayer acquired the asset at the transition time in return for the transition taxpayer starting to have an obligation to provide one or more financial benefits in relation to the Division 230 financial arrangement;

(b) in the case of a liability--that the transition taxpayer started to have the liability at the transition time in return for the transition taxpayer starting to have a right to receive one or more financial benefits under the Division 230 financial arrangement.

In this Subdivision:

"asset" means property, or a right, of any kind, and includes:

(a) any legal or equitable estate or interest (whether present or future, vested or contingent, tangible or intangible, in real or personal property) of any kind; and

(b) any chose in action; and

(c) any right, interest or claim of any kind including rights, interests or claims in or in relation to property (whether arising under an instrument or otherwise, and whether liquidated or unliquidated, certain or contingent, accrued or accruing); and

(e) a CGT asset;

but does not include trading stock.

"liability" includes a duty or obligation of any kind (whether arising under an instrument or otherwise, and whether actual, contingent or prospective).

Subdivision 57 - F -- Superannuation deductions

57 - 40 Contributions under defined benefit superannuation schemes

(1) This section applies to a deduction allowable apart from this Subdivision to the transition taxpayer under section 290 - 60 of the Income Tax Assessment Act 1997 for a contribution made to a fund in relation to a person if:

(a) the person was an employee of the transition taxpayer at any time before or after the transition time; and

(b) the contribution was made under a defined benefit superannuation scheme (within the meaning of section 6A of the Superannuation Guarantee (Administration) Act 1992 ).

Deduction allowable only if sum of all deductions exceeds defined benefit threshold amount

(2) The deduction is not allowable for a year of income if the sum of all deductions of the transition taxpayer to which this section applies for the year of income is less than or equal to the defined benefit threshold amount (see subsection (4)) for the year of income.

Amount of deduction not allowable

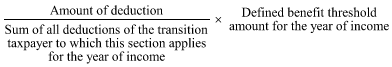

(3) If the sum is greater than that amount, so much of the deduction as is worked out using the following formula is not allowable:

Meaning of defined benefit threshold amount

(4) The defined benefit threshold amount for a year of income is:

(a) if the year of income is the transition year--the unfunded liability amount (see subsection (5)); or

(b) in any other case--that amount as reduced by the total amount of deductions to which this section applies, that, because of subsection (2) or (3), have not (disregarding section 57 - 55) been allowable to the transition taxpayer for all previous years of income.

Meaning of unfunded liability amount

(5) The unfunded liability amount is the value, worked out as at the transition time in accordance with actuarial principles, of the liabilities of the transition taxpayer to provide superannuation benefits for, or for dependants of, employees of the transition taxpayer, where the liabilities:

(a) had accrued as at the transition time; and

(b) were, according to actuarial principles, unfunded at that time; and

(c) were liabilities only under defined benefit superannuation schemes.

57 - 45 Deduction for surplus to meet defined benefit superannuation scheme liabilities

If:

(a) at the transition time, according to a particular defined benefit superannuation scheme's accounts, an amount is available to meet liabilities of the transition taxpayer under the scheme to provide superannuation benefits for, or for dependants of, employees of the transition taxpayer; and

(b) the amount exceeds the total value (as worked out according to actuarial principles) of the liabilities of that kind that have accrued as at the transition time; and

(c) before the transition time, the transition taxpayer makes a written election that the excess is to be used solely to meet liabilities of that kind accruing after the transition time, and the excess is later used solely to meet such liabilities;

the excess is an allowable deduction of the transition taxpayer for the transition year.

57 - 50 Contributions generally

(1) This section applies to a deduction allowable apart from this Subdivision to the transition taxpayer under section 290 - 60 of the Income Tax Assessment Act 1997 for a contribution made to a fund in relation to a person if the person was an employee of the transition taxpayer at any time before or after the transition time.

Deduction allowable only if sum of all deductions exceeds general superannuation threshold amount

(2) The deduction is not allowable for a year of income if the sum of all deductions of the transition taxpayer to which this section applies for the year of income is less than or equal to the general superannuation threshold amount (see subsection (4)) for the year of income.

Amount of deduction not allowable

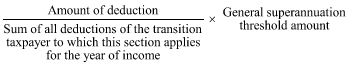

(3) If the sum is greater than the general superannuation threshold amount, so much of the deduction as is worked out using the following formula is not allowable:

Meaning of general superannuation threshold amount

(4) The general superannuation threshold amount for a year of income is:

(a) if the year of income is the transition year--the undischarged superannuation liability amount (see subsection (5)); or

(b) in any other case--the amount applicable under paragraph (a), reduced by the total amount of deductions to which this section applies that, because of subsection (2) or (3), have not (disregarding section 57 - 55) been allowable to the transition taxpayer for all previous years of income.

Meaning of undischarged superannuation liability amount

(5) This is how to work out the transition taxpayer's undischarged superannuation liability amount :

Step 1. For each person who was an employee of the transition taxpayer at any time before the transition time, take the sum of:

(a) if the whole or any part of the person's period of employment with the transition taxpayer took place before the beginning of the superannuation guarantee period (see subsection (6)) and there were one or more required award etc. contribution amounts (see subsection (7)) in respect of any of that whole or part--that amount or those amounts; and

(b) if, for the whole or any part or parts of the superannuation guarantee period, there were one or more required award etc. contribution amounts that were greater than the required superannuation guarantee contribution amount or amounts (see subsection (8))--that greater amount or those greater amounts; and

(c) if, for the whole or any part or parts of the superannuation guarantee period, either there was no required award etc. contribution amount or there was such an amount but it was not greater than the required superannuation guarantee contribution amount--the required superannuation guarantee contribution amount for the whole or the part of the period, or the sum of the required superannuation guarantee contribution amounts for the parts of the period, as the case may be.

Step 2. Reduce the sum from Step 1 by the sum of amounts that the transition taxpayer actually contributed before the start of the transition year:

(a) in payment of required award etc. contribution amounts or required superannuation guarantee contribution amounts for the employee that are included in the sum in Step 1; or

(b) voluntarily to a superannuation fund for the purpose of providing superannuation benefits for the employee, or dependants of the employee;

in respect of any period of employment of the employee with the transition taxpayer before the transition time.

Step 3. If the result after applying Step 2 for a particular employee is less than nil, it is nil instead.

Step 4. Add up the results for all of the employees. This final sum is the transition taxpayer's undischarged superannuation liability amount .

Meaning of superannuation guarantee period

(6) The superannuation guarantee period is the period beginning on 1 July 1992 and ending at the transition time.

Meaning of required award etc. contribution amount

(7) A required award etc. contribution amount is an amount required to be contributed to a superannuation fund by an employer for the benefit of an employee:

(a) by an industrial award; or

(b) by an occupational superannuation arrangement; or

(c) by a law of the Commonwealth, a State or a Territory; or

(d) otherwise.

Meaning of required superannuation guarantee contribution amount

(8) A required superannuation guarantee contribution amount is an amount that an employer would need to contribute in respect of a period so as not to have a superannuation guarantee shortfall under the Superannuation Guarantee (Administration) Act 1992 in respect of that period.

Note: The relevant periods for which shortfalls are or were calculated under that Act are quarters (from 1 July 1993 onwards) or half - years (from 1 July 1992 to 30 June 1993).

57 - 52 Section 57 - 50 does not apply if there is a surplus at transition time

Section 57 - 50 does not apply to a deduction of the kind mentioned in subsection 57 - 50(1) if:

(a) at the transition time, according to the accounts of the fund concerned, an amount is available to meet liabilities of the transition taxpayer in relation to the fund to provide superannuation benefits for, or for dependants of, employees of the transition taxpayer; and

(b) the amount exceeds the value (as worked out according to actuarial principles) of the liabilities of that kind that have accrued as at the transition time.

57 - 55 Deductions reduced under both sections 57 - 40 and 57 - 50

If the amount of a deduction otherwise allowable to the transition taxpayer in respect of a contribution to a fund is required to be reduced under both sections 57 - 40 and 57 - 50:

(a) if the reduction is of a different amount--the amount is reduced only under that section that requires the greater reduction; or

(b) if the reduction is of the same amount--the amount is reduced only under section 57 - 40.

Subdivision 57 - G -- Denial of certain deductions

57 - 60 Effect of pre - transition time accrued leave entitlements

(1) This section applies to a deduction otherwise allowable to the transition taxpayer for a year of income under subsection 51(1) of this Act or section 8 - 1 (about general deductions) of the Income Tax Assessment Act 1997 in respect of long service leave payments or annual leave payments to a person who was an employee of the transition taxpayer at any time before or after the transition time.

Note: Subsection 51(3) of this Act or section 26 - 10 of the Income Tax Assessment Act 1997 (as appropriate) contains additional requirements for certain leave payments to be deductible.

Deduction allowable only if sum of all deductions exceeds leave threshold amount

(2) The deduction is not allowable if the sum of all deductions of the transition taxpayer to which this section applies for the year of income is less than or equal to the leave threshold amount (see subsection (4)) for the year of income.

Amount of deduction not allowable

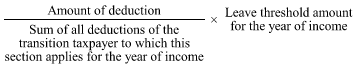

(3) If the sum is greater than the leave threshold amount, so much of the deduction as is worked out using the following formula is not allowable:

Meaning of leave threshold amount

(4) The leave threshold amount for a year of income is:

(a) if the year of income is the transition year--the (pre - transition time service) leave amount (see subsection (5)) of the transition taxpayer; or

(b) in any other case--that amount as reduced by the total amount of deductions to which this section applies that, because of subsection (2) or (3), have not been allowable to the transition taxpayer for all previous years of income.

Meaning of (pre - transition time service) leave amount

(5) The (pre - transition time service) leave amount of the transition taxpayer is the sum of the following amounts:

(a) the amount that would be payable by the transition taxpayer in respect of annual leave and long service leave if, at the transition time, all employees of the transition taxpayer began to take all leave of that kind that they were eligible to take; and

(b) if the transition taxpayer elects, in accordance with subsection (6), that this paragraph applies--the amount that, according to actuarial principles, would need to be set aside at the transition time to meet all obligations of the transition taxpayer that might reasonably be expected to arise after that time to make annual leave payments and long service leave payments (other than in respect of leave taken into account under paragraph (a)) for periods of service of employees occurring before the transition time; and

(c) if paragraph (b) does not apply--the present value, at the transition time, of all annual leave payments and long service leave payments (other than in respect of leave taken into account under paragraph (a)) that the transition taxpayer would become liable to make after that time in respect of periods of service of employees occurring before that time if all such leave became eligible to be taken.

Election

(6) The election mentioned in paragraph (5)(b) must be made in writing before:

(a) the day by which the transition taxpayer's return of income for the transition year is due to be lodged; or

(b) such later day as the Commissioner allows.

57 - 65 Treatment of bad debts

(1) This section applies to a deduction otherwise allowable to the transition taxpayer for a year of income under this Act for the writing off as bad of the whole or part of a debt owing to the transition taxpayer.

Deduction allowable only if sum of all deductions exceeds doubtful debt provision limit

(2) The deduction is not allowable if the sum of all deductions of the transition taxpayer to which this section applies for the year of income is less than or equal to the doubtful debt provision limit (see subsection (4)) for the year of income.

Amount of deduction not allowable

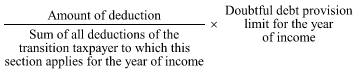

(3) If the sum is greater than that limit, so much of the deduction as is worked out using the following formula is not allowable:

Meaning of doubtful debt provision limit

(4) The doubtful debt provision limit for a year of income is:

(a) if the year of income is the transition year--the pre - transition doubtful debt limit (see subsection (5)); or

(b) in any other case--that limit as reduced by the total amount of deductions to which this section applies that, because of subsection (2) or (3), have not been allowable to the transition taxpayer for all previous years of income.

Meaning of pre - transition doubtful debt limit

(5) The pre - transition doubtful debt limit is the total of the amounts that, under generally accepted accounting principles, would be the appropriate doubtful debt provisions in relation to all debts owed to the transition taxpayer as at the transition time.

Reduction of limit for excess recovery

(6) If:

(a) at the transition time, a debt is owed to the transition taxpayer; and

(b) the sum of:

(i) the amount (if any) that, under generally accepted accounting principles, would be the appropriate doubtful debt provision in relation to the debt as at the transition time; and

(ii) any amounts later recovered in respect of the debt;

exceeds the amount of the debt;

the pre - transition doubtful debt limit is reduced by the amount of the excess.

Reduction of limit if debt later disposed of

(7) If:

(a) at the transition time, a debt is owed to the transition taxpayer; and

(b) there is an amount (the debt provision amount ) greater than nil that, under generally accepted accounting principles, would be the appropriate doubtful debt provision in relation to the debt as at the transition time; and

(c) after the transition time, the transition taxpayer disposes of the debt to another person;

the pre - transition doubtful debt limit is reduced by:

(d) if, after the transition time, the transition taxpayer wrote off part of the debt as bad--the excess (if any) of the debt provision amount over the amount or amounts so written off; or

(e) in any other case--the debt provision amount.

57 - 70 Treatment of superannuation lump sums and employment termination payments

(1) This section applies to a deduction otherwise allowable to the transition taxpayer for a year of income under section 8 - 1 (about general deductions) or 25 - 50 (about pensions, gratuities or retiring allowances) of the Income Tax Assessment Act 1997 for a superannuation lump sum or an employment termination payment for a person who was an employee of the transition taxpayer at any time before the transition time (regardless of whether the person was an employee at or after the transition time).

(2) So much (if any) of the deduction as relates to a period of service of the employee before the transition time is not allowable.

(3) This section does not apply to an early retirement scheme payment (within the meaning of the Income Tax Assessment Act 1997 ), or a genuine redundancy payment (within the meaning of that Act).

Subdivision 57 - H -- Domestic losses

In applying section 36 - 15 or 36 - 17 of the Income Tax Assessment Act 1997 (about how to deduct tax losses) to the transition taxpayer:

(a) only exempt income derived at or after the transition time is taken into account as exempt income of the transition taxpayer; and

(b) the transition taxpayer's deductions are taken into account only so far as they are in respect of:

(i) services rendered; or

(ii) goods provided; or

(iii) the doing of any other thing;

at or after the transition time.

Subdivision 57 - J -- Capital allowances and certain other deductions

57 - 85 What are the modified deduction rules and corresponding deduction provisions ?

(1) A modified deduction rule is a provision listed in column 3 of an item in the table in subsection (3). Provisions of the Income Tax Assessment Act 1997 are identified in normal text, while provisions of the Income Tax Assessment Act 1936 are in bold .

(2) The corresponding deduction provision (if any) for a modified deduction rule listed in column 3 of an item in the table in subsection (3) is the provision of the Income Tax Assessment Act 1936 listed in column 4 of the item.

(3) The table is as follows:

Modified deduction rules and corresponding deduction provisions | |||

Column

1 | Column 2 | Column 3 | Column 4

|

1 | Borrowing expenses | Section 25 - 25 | Former section 67 |

5 | Former Division 10BA of Part III |

| |

7 | Industrial property (copyright in Australian film) | Former Division 10B of Part III |

|

9 | Gifts | Section 25 - 50 and Division 30 | Former section 78 |

13 | R&D | Division 355 |

|

14 | Scientific research | Section 73A |

|

18 | Cost of acquiring trees | Section 70 - 120 | Former section 124J |

19 | Capital allowances | Division 40 |

|

57 - 90 Post - transition deductions--assume that the transition taxpayer had never been exempt

In working out the transition taxpayer's allowable deductions under a modified deduction rule for the transition year or a later year of income, assume that the modified deduction rule had applied at all times before the transition time as if the transition taxpayer's income had never been exempt from income tax.

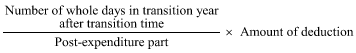

57 - 95 Amount of deduction not allowable for transition year

(1) If, apart from this section, an amount would be an allowable deduction under a modified deduction rule for the transition year in respect of expenditure incurred before the transition time (whether or not during the transition year), only so much of the amount as is worked out using the following formula is so allowable:

where:

"post-expenditure part" means:

(a) if the expenditure was incurred before the transition year--the number of days in the transition year; or

(b) otherwise--the number of days in the period from the beginning of the day on which the expenditure is incurred until the end of the transition year.

(2) This section does not apply to an amount to which paragraph 57 - 110(1)(b) (which deals with balancing adjustments) applies.

57 - 100 No elections etc. before transition time

In working out the transition taxpayer's allowable deductions under a modified deduction rule:

(a) assume that the transition taxpayer did not, at any time, make any election or declaration, or give any notice, under the rule in relation to a year of income before the transition year; and

(b) any election or declaration (other than one under former subsection 124ZADA(1)) the transition taxpayer makes, or any notice the transition taxpayer gives, under the rule in relation to the transition year has no effect in so far as it relates to expenditure incurred before the transition time.

57 - 105 Special rules for mining and quarrying

Exploration and prospecting--assume no expenditure

(1) In working out the transition taxpayer's allowable deductions under the former Subdivision 330 - A or 330 - C or Division 40 of the Income Tax Assessment Act 1997 , assume that the transition taxpayer incurred no expenditure on exploration and prospecting before the transition time.

Assume that no excess deductions available

(2) In working out the transition taxpayer's allowable deductions under the former Subdivision 330 - A or 330 - C of the Income Tax Assessment Act 1997 , assume that, for each year of income before the transition year, the transition taxpayer's assessable income would have exceeded the total of the transition taxpayer's deductions for the year.

Note: This means that the transition taxpayer can have no excess deductions remaining from years of income before the transition year.

Subdivision 57 - K -- Balancing adjustments

57 - 110 Apportionment of balancing adjustments

(1) If, apart from this subsection, a balancing adjustment provision (see subsection (2)) would:

(a) require an amount to be included in the transition taxpayer's assessable income for the transition year or a later year of income in respect of particular expenditure; or

(b) allow an amount as a deduction from the transition taxpayer's assessable income for the transition year or a later year of income in respect of particular expenditure;

then only so much of the amount as is worked out using the following formula is so included or allowable:

![]()

where:

"actual deductions" is the sum of all deductions actually allowed or allowable to the transition taxpayer for the expenditure under the deduction rule to which the balancing adjustment provision relates (see subsection (2)).

"notional deductions" is the sum of all deductions for the expenditure that would have been allowable to the transition taxpayer under the deduction rule to which the balancing adjustment provision relates, if the transition taxpayer had never been wholly exempt from income tax.

(2) Each balancing adjustment provision and its related deduction rule are shown in an item of the table. Provisions of the Income Tax Assessment Act 1997 are shown in ordinary text, and provisions of the Income Tax Assessment Act 1936 are shown in bold .

Balancing adjustment provisions and related deduction rules | |||

|

| Balancing adjustment provision | Deduction rule to which the balancing adjustment provision relates |

1 | Capital works: buildings, structural improvements, environment protection earthworks and extensions, alterations or improvements | Section 43 - 40 | Division 43 and whichever of former Divisions 10C and 10D of Part III is appropriate |

2A | Capital allowances | Section 40 - 285 | Division 40 |

5 | Industrial property (copyright in Australian film) | Former sections 124N and 124P | Former Division 10B of Part III |

7 | R&D | ||

8 | Scientific research | Subsection 73A(4) | Section 73A |

Note: Item 7 of the table is expanded by section 355 - 340 of the Income Tax (Transitional Provisions) Act 1997 .

Subdivision 57 - L -- Trading stock

57 - 115 Modification of trading stock provisions

(1) For the purposes of applying Division 70 of the Income Tax Assessment Act 1997 in relation to the transition year, the only trading stock of the transition taxpayer that is to be taken into account under section 70 - 35 of that Act as being on hand at the beginning of the transition year is such trading stock as was on hand at the transition time.

(2) For the purpose of working out the value at which the trading stock is to be taken into account, the year of income preceding the transition year is taken to have ended immediately before the transition time.

Note: The value of trading stock on hand at the beginning of the transition year will, under section 70 - 40 of the Income Tax Assessment Act 1997 , be the same as at the end of the preceding year of income.

(3) If:

(a) the basis of valuation of the trading stock at the end of the transition year is cost; and

(b) the basis of valuation at the beginning of the transition year is different;

then, for the purposes of the valuation at the end of the transition year, the cost of the trading stock for the purposes of Division 70 of the Income Tax Assessment Act 1997 is taken to be equal to the value at which it was taken into account at the beginning of the transition year.

Subdivision 57 - M -- Imputation

57 - 120 Cancellation of franking surplus, credit or debit

Cancellation of surplus

(1) Subject to subsections (3) and (4), if, immediately before the transition time, the transition taxpayer or a subsidiary (see section 57 - 125) of the transition taxpayer has a franking surplus, then the surplus is reduced to nil at the transition time.

Cancellation of credit/debit

(2) Subject to subsections (3) and (4), if:

(a) at any time after the transition time, there arises a franking credit or a franking debit of the transition taxpayer or of a subsidiary of the transition taxpayer; and

(b) the franking credit or franking debit is to any extent attributable to a period, or to an event taking place, before the transition time;

the franking credit or franking debit is to that extent taken not to have arisen.

Cases where subsections (1) and (2) do not apply to the transition taxpayer

(3) If:

(a) one or more franking debits of the transition taxpayer arise after the transition time; and

(b) any of the debits is to an extent (the amount of which is the pre - transition time component of the debit) attributable to the period, or to an event taking place, before the transition time; and

(c) immediately before the transition time:

(i) there was a franking surplus of the transition taxpayer that was less than the total of the pre - transition time components of all of the debits; or

(ii) there was no franking surplus of the transition taxpayer;

then:

(d) in a case covered by subparagraph (c)(i)--subsection (1) does not apply to the surplus; and

(e) in any case--subsection (2) does not apply to the debits.

Cases where subsections (1) and (2) do not apply to a subsidiary

(4) If:

(a) one or more franking debits of a subsidiary of the transition taxpayer arise after the transition time; and

(b) any of the debits is to an extent (the amount of which is the pre - transition time component of the debit) attributable to the period, or to an event taking place, before the transition time; and

(c) immediately before the transition time:

(i) there was a franking surplus of the subsidiary that was less than the total of the pre - transition time components of all of the debits; or

(ii) there was no franking surplus of the subsidiary;

then:

(d) in a case covered by subparagraph (c)(i)--subsection (1) does not apply to the surplus; and

(e) in any case--subsection (2) does not apply to the debits.

(1) A company (the subsidiary company ) is a subsidiary of another company (the holding company ) if all the shares in the subsidiary company are beneficially owned by:

(b) one or more subsidiaries of the holding company; or

(c) the holding company and one or more subsidiaries of the holding company.

(2) A company (other than the subsidiary company) is a subsidiary of the holding company if, and only if:

(a) it is a subsidiary of the holding company; or

(b) it is a subsidiary of a subsidiary of the holding company;

because of any other application or applications of this section.

Subdivision 57 - N -- Division not applicable in respect of certain plant

57 - 130 Plant or depreciating assets covered by Subdivision 58 - B of the Income Tax Assessment Act 1997

(1) Subdivision 57 - J, and Subdivision 57 - K in so far as it applies to balancing adjustments for plant or depreciating assets, do not apply in respect of an asset to which Subdivision 58 - B of the Income Tax Assessment Act 1997 applies.

(2) Despite subsection (1), Subdivision 57 - J applies for the purposes of section 40 - 35 of the Income Tax (Transitional Provisions) Act 1997 to capital expenditure incurred by a transition taxpayer before 1 July 2001 that relates to property that is not a depreciating asset.

Subdivision 57 - P -- Balancing adjustment on ceasing to have a Division 230 financial arrangement

(1) This section applies if:

(a) section 57 - 32 was applied to work out the market value of an asset (the subject asset ); and

(b) the transition taxpayer is a party to the Division 230 financial arrangement (the financial arrangement ) to which the subject asset, or the corresponding liability for the subject asset, is or is part of; and

(c) a balancing adjustment is made under Subdivision 230 - G of the Income Tax Assessment Act 1997 , after the transition time, in relation to the financial arrangement.

(2) For the purposes of making the balancing adjustment under Subdivision 230 - G of the Income Tax Assessment Act 1997 in relation to the financial arrangement, adjust the amount worked out using the method statement (the method statement ) in subsection 230 - 445(1) of that Act by:

(a) if the transition taxpayer is the holder of the subject asset--increasing any gain or reducing any loss by the amount worked out under subsection (4) of this section; or

(b) if the transition taxpayer is the holder of the corresponding liability for the subject asset--reducing any gain or increasing any loss by the amount worked out under subsection (4) of this section.

(3) Despite subsection (2):

(a) if the amount worked out under subsection (4) exceeds the amount of the loss to be reduced under paragraph (2)(a)--the transition taxpayer is taken, for the purposes of making the balancing adjustment, to have made a gain equal to the amount of the excess; or

(b) if the amount worked out under subsection (4) exceeds the amount of the gain to be reduced under paragraph (2)(b)--the transition taxpayer is taken, for the purposes of making the balancing adjustment, to have made a loss equal to the amount of the excess; or

(c) if when applying the method statement no balancing adjustment is made in relation to the financial arrangement--the transition taxpayer is taken, for the purposes of making the balancing adjustment, to have:

(i) if the transition taxpayer is the holder of the subject asset--made a gain equal to the amount worked out under subsection (4); or

(ii) if the transition taxpayer is the holder of the corresponding liability for the subject asset--made a loss equal to the amount worked out under subsection (4).

(4) For the purposes of subsections (2) and (3), the amount is the difference between:

(a) the amount that the transition taxpayer would need to receive or pay under the financial arrangement without an amount being assessable income of, or deductible to, the transition taxpayer if the subject asset, or the corresponding liability for the subject asset, were disposed of at the time the balancing adjustment is made; and

(b) the amount that the transition taxpayer would need to receive or pay under the financial arrangement without an amount being assessable income of, or deductible to, the transition taxpayer if:

(i) the subject asset, or the corresponding liability for the subject asset, were disposed of at the time the balancing adjustment is made; and

(ii) the assumptions in subsection (5) were made.

(5) The assumptions referred to in subparagraph (4)(b)(ii) are that, when the financial arrangement was entered into:

(a) the parties to the arrangement were dealing with each other at arm's length (within the meaning of the Income Tax Assessment Act 1997 ) in relation to the arrangement; and

(b) if the arrangement gives rise to an interest that is not an equity interest in an entity--the return on the interest would reasonably be expected to be equal to the benchmark rate of return (within the meaning of the Income Tax Assessment Act 1997 ) for the interest.

(6) This section applies despite section 230 - 510 of the Income Tax Assessment Act 1997 .