Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

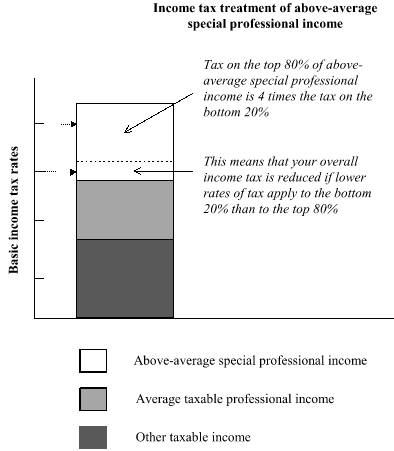

Commonwealth Consolidated Acts(1) If you have above - average special professional income, the Income Tax Rates Act 1986 generally sets a special rate so that the amount of income tax you pay on the top 4 / 5 of your above - average special professional income is effectively 4 times what you would pay on the bottom 1 / 5 of that income at basic rates.

Note : Your overall income tax will be less only if 2 marginal rates of income tax would apply to your above - average special professional income if it were treated as the top slice of your taxable income.

(2) The following diagram illustrates how the special rate works.