Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts(1) If either of the following conditions is satisfied in relation to the asset - test exempt income stream to which this Subdivision applies:

(a) the income stream is covered by subsection 9BA(1);

(b) on the income stream's commencement day, there was a reasonable likelihood that the income stream would have been covered by subsection 9BA(1), but the income stream is no longer covered by that subsection;

the annual rate of ordinary income of a person from the income stream is worked out under whichever of subsections (2) and (3) is applicable.

Recipient makes election

(2) If:

(a) the person has elected that a particular amount is to be the payment, or the total of the payments, to be made under the income stream in respect of a period (the payment period ) that:

(i) consists of the whole or a part of a particular financial year; and

(ii) begins on or after the income stream's commencement day; and

(b) the election is in force on a particular day in the payment period;

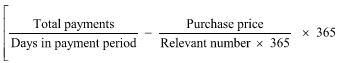

the annual rate of ordinary income of the person from the income stream on that day is worked out using the following formula:

where:

"purchase price" has the meaning given by subsection 9(1).

"relevant number" has the meaning given by subsection 9(1).

"total payments" means the payment, or the total of the payments, to be made under the income stream in respect of the payment period.

Recipient does not make election

(3) If the person has not elected that a particular amount is to be the payment, or the total of the payments, to be made under the income stream in respect of a period (the payment period ) that:

(a) consists of the whole or a part of a particular financial year; and

(b) begins on or after the income stream's commencement day;

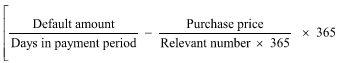

the annual rate of ordinary income of the person from the income stream on each day during the payment period is worked out using the following formula:

where:

"default amount" means 100% of the amount worked out for the financial year using the formula in subsection 9BA(5) (for pro - rating, see subsection (4)).

"purchase price" has the meaning given by subsection 9(1).

"relevant number" has the meaning given by subsection 9(1).

(4) If the income stream's commencement day is not a 1 July, the default amount (within the meaning of subsection (3)) for the financial year starting on the preceding 1 July must be reduced on a pro - rata basis by reference to the number of days in the financial year that are on and after the commencement day.

Exception--income stream's commencement day happens in June

(5) If:

(a) the income stream's commencement day happens in June; and

(b) no payment is made under the income stream for the financial year in which the commencement day happens;

subsections (2), (3) and (4) do not apply in working out the annual rate of ordinary income of the person from the income stream on a day in that financial year.