South Australian Current Acts

South Australian Current Acts South Australian Current Acts

South Australian Current ActsSchedule—The Indenture

THIS INDENTURE made the 16th day of October,

1975 BETWEEN: THE STATE OF SOUTH AUSTRALIA (hereinafter referred to as "the

State") of the first part THE MINISTER OF MINES AND ENERGY the Minister

administering the Petroleum Act, 1940-1971 and the Mining

Act, 1971-1973, a corporation sole pursuant to the provisions of the said

Mining Act of the second part SANTOS LIMITED a company incorporated under the

laws of the State of South Australia of the third part DELHI INTERNATIONAL OIL

CORPORATION a company incorporated under the laws of the State of Delaware,

United States of America (hereinafter with its successors and assigns

sometimes referred to as "Delhi") of the fourth part ALLIANCE PETROLEUM

AUSTRALIA N.L. a company incorporated under the laws of the State of Victoria

of the fifth part BASIN OIL N.L. a company incorporated under the laws of the

State of New South Wales of the sixth part BRIDGE OIL N.L. a company

incorporated under the laws of the State of New South Wales of the seventh

part PURSUIT OIL N.L. a company incorporated under the laws of the State of

Victoria of the eighth part REEF OIL N.L. a company incorporated under the

laws of the State of New South Wales of the ninth part and VAMGAS NO LIABILITY

a company incorporated under the laws of the State of New South Wales of the

tenth part (the said companies being hereinafter sometimes collectively called

"the Producers" which expression shall include their respective successors and

assigns).

WHEREAS:

In recognition of the importance to the State of the operations of the

Producers in the provision of State's energy requirements, in the provision of

petrochemical feedstock vital to the establishment of a petrochemical industry

in the State of South Australia and in the exploration for and development of

the State's petroleum resources and in order that such operations may be

rationalised so as to optimise the recovery of the State's petroleum reserves,

the parties have agreed to enter into this Indenture.

NOW THIS DEED WITNESSETH THAT THE PARTIES COVENANT AND AGREE as follows:

1. DEFINED TERMS

In this Indenture except where terms are expressly defined hereunder the Acts

Interpretation Act, 1915-1972 of the State shall apply to the

construction and interpretation of this Indenture as if this Indenture were an

Act and in this Indenture unless the context otherwise requires—

(1) "Act": any

reference in this Indenture to an Act means that Act whether an Act of State

or Federal Parliaments as amended from time to time and includes any Act

passed in substitution for that Act and regulations or by-laws made and in

force under any such Act.

(1A) "GST" means the

tax payable under the GST law.

(1B) "GST component"

means a component attributable to a liability to GST.

(1C) "GST law" means:

(a)

A New Tax System (Goods and Services Tax) Act 1999 of the Commonwealth;

and

(b) the related

legislation of the Commonwealth dealing with the imposition of a tax on the

supply of goods and services.

(2) "Minister" means

the Minister for the time being administering the Petroleum

Act, 1940-1971 of the State.

(3) "Person" includes

any company corporation or other bodies corporate and the Commonwealth of

Australia and any agency authority or instrumentality of the State or of the

Commonwealth of Australia of whatsoever nature or kind and howsoever named or

called.

(4) "Petroleum

Exploration Licence" means any licence lease or other authority (by whatsoever

name called) from time to time issued by the State or Minister and conferring

upon the holder thereof the right to explore for petroleum and includes any

right title or other interest (other than a Petroleum Production Licence)

created out of derived from or arising pursuant to any such licence lease or

other authority.

(5) "Petroleum

Production Licence" means any licence lease or other authority (by whatsoever

name called) from time to time issued by the State or Minister and conferring

upon the holder thereof the right inter alia to produce petroleum and includes

any right title or other interest created out of derived from or arising

pursuant to any such licence lease or other authority.

(6) "Petroleum Rights"

means the sub-licences referred to in Clause 6(1) (b) hereof.

(7) "Sales Contracts"

means:

(a) the Gas Sales

Contract in the form of that submitted to the Minister prior to the date

hereof and to be entered into between the Producers and the Pipelines

Authority of South Australia ("P.A.S.A.") and any agreement approved by the

Minister or his predecessor entered into by all of the Producers together with

Total Exploration Australia Pty. Ltd. prior to the date hereof for the sale of

natural gas and as any of the foregoing may be amended varied or supplemented

from time to time;

(b) any agreement

hereafter entered into between the Producers and P.A.S.A. providing for the

supply of natural gas as fuel gas for any petrochemical industry hereafter

established in the State and any other agreement or agreements in force from

time to time amending varying or supplementing the same;

(c) any agreement or

agreements or other disposal arrangements entered into by the Producers or any

of them from time to time for the sale of liquid hydrocarbons and/or

petrochemical feedstock derived from the Unitized Substances or from petroleum

recovered from any area comprised in a Petroleum Production Licence granted to

the Producers within the Subject Area and areas referred to in

clause 6(10) of this Indenture;

(d) any agreement or

agreements entered into by the Producers or any of them from time to time with

an arms length purchaser for the sale of Unitized Substances; and

(e) any agreement or

agreements entered into between Santos Limited, Delhi, Vamgas No Liability and

P.A.S.A.

copies of which shall be provided in confidence to the Minister.

(8) "Subject Area"

means the "Subject Area" as defined in the Unit Agreement.

(9) "This Indenture"

means this Indenture as the same may be amended added to or varied from time

to time in accordance with the provisions of clause 15 hereof.

(10) "Unit Agreement"

has the same meaning as in the Act.

(11) "Unit Facilities"

means "Unit Facilities" as defined in the Unit Agreement.

(12) "Utilized

Substances" means "Unitized Substances" as defined in the Unit Agreement.

(13) "the Exploration

Indenture" means an Indenture in the form of that submitted to the Minister

prior to the date hereof and to be entered into between the Producers together

with Total Exploration Australia Pty. Ltd. of the one part and the Minister of

the other part relating to expenditure on exploration for petroleum.

(14) "the P.A.S.A.

Future Requirements Agreement" means an agreement in the form of that

submitted to the Minister prior to the date hereof and to be entered into

between the Producers (together with Total Exploration Australia Pty. Ltd. and

the Commonwealth of Australia) of the first to tenth parts inclusive P.A.S.A.

of the eleventh part and the Minister of the twelfth part granting certain

pre-emptive rights in respect to the future natural gas requirements of

P.A.S.A.

(15) "Joint Operating

Agreement" means any agreement heretofore or hereafter entered into by or

including the Producers or some of them and approved by the Minister governing

exploration for and production of petroleum and includes any agreement

providing for the installation and as applicable sharing of use of facilities

for the handling of petroleum.

(16) "Authorised

Agreement" has the same meaning as in the Act.

2. RATIFICATION

(1) The Government of

the State shall as soon as practicable introduce and sponsor a Bill into the

Parliament of the State to approve and ratify this Indenture and to provide

for carrying it into effect and the said Government will endeavour to secure

its passage and have it come into operation as an Act prior to the 31st day of

December, 1975 or such later date as the parties hereto may mutually agree.

(2) If such a Bill is

not so passed so as to come into operation as an Act before the 31st day of

December, 1975 or such later date as the parties may as hereinbefore provided

agree the Clauses of this Indenture (other than Clause 2(1) and this Clause

2(2)) shall not come into operation and none of the parties hereto will have

any claim against any other of them with respect to any matter or thing

arising out of done performed or omitted to be done or performed under this

Indenture provided always that nothing hereinbefore contained shall (unless

otherwise expressly agreed in writing by the Producers) operate or be deemed

to operate so as to restrict derogate from or otherwise affect any of the

rights or benefits to which the Producers or any of them are at such date

entitled whether in respect to Petroleum Exploration Licences Nos. 5 and 6 or

Petroleum Production Licences Nos. 1–5 or otherwise.

(3) Upon the said Bill

commencing to operate as an Act all the provisions of this Indenture shall

operate and take effect.

(4) If the State

should at any time pass any legislation or if any regulation is made which

modifies the rights or increases the obligations of the Producers or any of

them under the ratifying Act or under this Indenture and if the State upon

notification by the Producers fails within a period of six months to rectify

such matter then the Producers shall (but without in any way derogating from

the rights or remedies of the Producers in respect of a breach of this

Indenture) have the right to terminate this Indenture by notice to the State

at any time following the expiry of such six month period.

3. INITIAL OBLIGATIONS

(1) The performance by

the Producers of their obligations under:

(a) Clause 3(4) (a) of

this Indenture is (unless otherwise notified in writing by the Producers to

the State) made subject to:

(i)

each Producer being satisfied that suitable arrangements

have been made for the financing of its and of each of the other Producers

obligations under this Indenture and under the Unit Agreement relevant to the

Sales Contracts referred to in Clause 1(7) (a) hereof;

and

(ii)

execution of a Deed of Covenant and Release to be made

between The Australian Gas Light Company of the first part Norman Egan

Connellan of the second part the Producers and Total Exploration Australia

Pty. Ltd. of the third to eleventh parts inclusive the State of the twelfth

part and P.A.S.A. of the thirteenth part and execution of a deed supplemental

thereto whereby certain of the rights and obligations to be acquired pursuant

to the agreements and documents referred to in Clause 9(6) hereof are to be

subject to the said Deed of Covenant and Release.

(2) Performance by the

State of its obligations under this Indenture is (with the exception of

Clauses 10(1) and 19 hereof) made subject to execution by the Producers of the

Unit Agreement the Gas Sales Contract referred to in Clause 1(7) (a) hereof,

the Exploration Indenture and the P.A.S.A. Future Requirements Agreement.

(3) The Minister

undertakes upon presentation of the executed Unit Agreement to grant or

procure the grant of all such approvals as may be required in respect thereto

pursuant to the Petroleum Act, 1940-1971 of the State.

(4) —

(a) Upon written

notification by the Producers of the due fulfilment of the Conditions

Precedent in Clause 3(1) (a) hereof the Producers shall execute (if not

already the case):

(i)

the Gas Sales Contract referred to in Clause 1(7) (a)

hereof

(ii)

the Unit Agreement

(iii)

the Exploration Indenture

and

(iv)

the P.A.S.A. Future Requirements Agreement

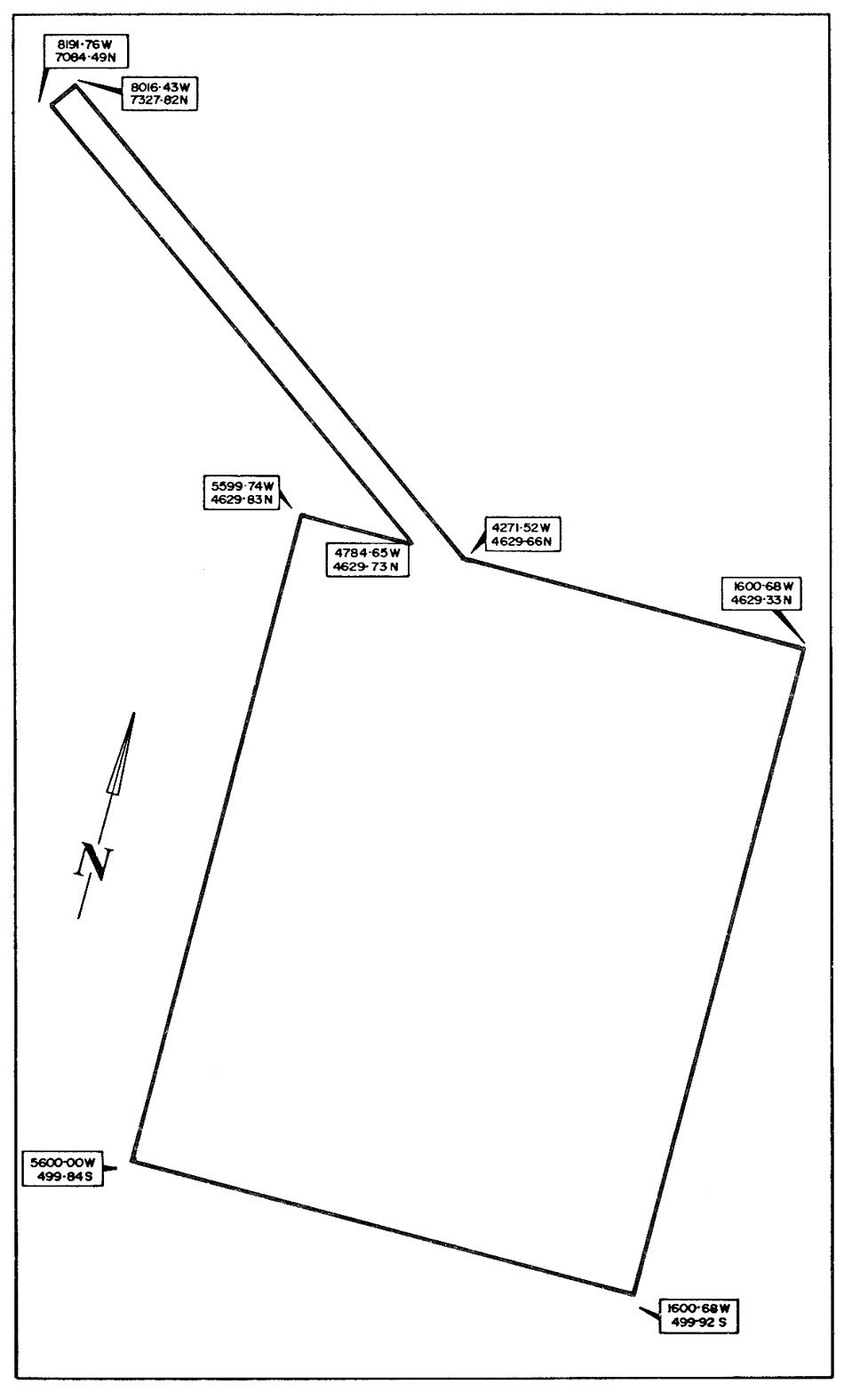

4. LAND AT MOOMBA

(1) At the request of

the Producers the State shall grant (or procure the grant) to the Producers or

as the Producers may direct the fee simple estate of the land delineated in

red on the plans annexed hereto as Appendix "A" and delineated in Appendix "C"

to the extent not delineated in Appendix "A" and shall grant (or procure the

grant of) any easements and rights which the Producers may reasonably require

for the purpose of the full enjoyment of the said land. Any such grant of the

fee simple estate as aforesaid shall be made free and clear of all easements

of whatsoever nature or kind other than as may have been previously advised in

writing by the State and expressly agreed by the Producers and shall be made

free and clear of all liens, charges and encumbrances.

(2) Any and all

buildings structures improvements plant equipment or other property of

whatsoever nature or kind (and any part of any such buildings structures

improvements plant equipment or other such property of whatsoever nature or

kind) now or hereafter situate upon or under or forming part of or attached to

or annexed to the said land shall notwithstanding any provision of any Act or

of any rule of law to a contrary effect be and shall be deemed conclusively to

be chattels and shall be owned by and may be transferred mortgaged charged or

assigned by the Producers or such of them as are entitled thereto all in

accordance with and subject to the provisions of the Unit Agreement or other

agreement pursuant to which any of the foregoing may be owned from time to

time.

(3) The State shall

ensure that the said land shall be and remain zoned for use or otherwise

protected so as to preserve the use of the said land in respect of petroleum

production and treatment and matters ancillary thereto.

(4) The said land

shall not be declared or included in any water district under the Waterworks

Act, 1932-1966 or any re-enactment or amendment thereof.

(5) In the event of

the Producers and the State hereafter mutually determining that it is

desirable to establish a township in the vicinity of Moomba in the State of

South Australia the State will give consideration to the provision of

additional land for housing and housing accommodation for persons (including

their dependants) engaged in the operations of the Producers and any one else

(including their dependants) connected directly or indirectly with the

Producers operations. If additional land and housing accommodation is to be

provided by the State at no cost to the Producers the State shall fix such

prices rents or charges as are fair and reasonable in the circumstances for

the land and housing accommodation provided by it. The State will provide

education health and other facilities normally provided by the State being

commensurate with the population and locality of such township.

5. INFRASTRUCTURE AT MOOMBA AND ROADS

(1) In this clause

"heavy vehicle" means a vehicle which requires a permit in respect of its size

or its load or its size and its load from the Road Traffic Board pursuant to

sections 140, 141, 142 and 147 of the Road Traffic Act, 1961-1974.

(2) Subject to this

Clause 5 the State shall at no cost to the Producers maintain and where

necessary remake or upgrade that part of the road known as the Strzelecki

Track which lies between Lyndhurst and Moomba (hereinafter referred to as "the

said road") to enable vehicles other than heavy vehicles to use the said road.

(3) Within 24 months

of the date of the ratification of this Indenture the State shall remake or

upgrade the said road to a standard which would enable the said road to be

reinstated for use by vehicles other than heavy vehicles within a reasonable

period after the passage of the peak of a flood of equal magnitude to the peak

of the flood which occurred during the first half of 1974.

(4) In the event of a

flood of less than or equal magnitude to the peak of the flood which occurred

during the first half of 1974 the State shall ensure that the road is

reinstated for use to the standard referred to in Clause 5(3) hereof as soon

as is reasonably practicable and in any event the State will endeavour to

ensure that the road will be reinstated within eight weeks after the passage

of the peak of such flood or such longer period as the State and the Producers

may agree.

(5) The Producers

shall advise the State and the Commissioner of Highways if and when it is

proposed to use a heavy vehicle for travel on the said road and upon receipt

of that advice, the State shall direct the Commissioner of Highways to remake

or upgrade the road where necessary and further if required by the

Commissioner of Highways the Producers shall agree with the State that they

shall pay the full cost as previously agreed in writing by the Producers of

remaking or upgrading the road where required for that use and the full cost

of restoration of all damage to the road arising from that use. In determining

the costs (if any) payable by the Producers the State agrees that the

Commissioner of Highways shall have due regard to the cost incurred by the

Producers whether before or after the date of this Indenture upon the road

referred to herein.

(6) Where any pipeline

owned or used by the Producers in respect of petroleum gathering or production

pursuant to this Indenture crosses under or over any road under the control

and jurisdiction of the Commissioner of Highways the Producers shall at their

cost provide such clear cover and other protection as may be required by the

Commissioner of Highways.

6. PETROLEUM LICENCES

(1) Upon application

at any time by the Producers (or such of them as are entitled to apply for the

same which for the purpose of Section 27(1) of the Petroleum

Act, 1940-1971 of the State shall include the holder of a Petroleum

Exploration Licence and any person deriving an interest therefrom in respect

to the area of land to be comprised therein) the Minister shall:

(a) grant to the

Producers (or such of them as aforesaid) Petroleum Production Licences in the

form of or to the effect set out in Appendix "B" hereto; and

(b) approve the grant

of sub-licences in the form or to the effect set out in Appendix "B" hereto;

or in either case in such other form as may be agreed between the Minister and

the Producers in order to implement or otherwise give effect from time to time

to the provisions of the Unit Agreement or the relevant Joint Operating

Agreement and unless otherwise mutually agreed the State shall ensure that the

terms covenants and conditions of such Petroleum Production Licences shall

during the currency thereof (including any renewal or renewals thereof) remain

as at the date of the grant thereof and that the State will not by legislation

regulation order or administrative action restrict any right to the grant or

renewal of such licences nor restrict or prevent the Producers or any of them

from giving effect to their rights and obligations under the Sales Contracts

referred to in Clauses 1(7) (a) and (b) hereof or under any other Sales

Contracts (in so far as they are entered into with an arms length purchaser)

or under the P.A.S.A. Future Requirements Agreement or under any contract

entered into pursuant thereto or under the Unit Agreement (which for the

purposes of this sub-clause shall be construed as a reference only to the

Unit Agreement in the form approved by the Minister and with such amendments

thereto as have previously been agreed to by the Minister) or any Joint

Operating Agreement in so far as it applies to the Subject Area.

(1A) However—

(a) an application

under subclause (1) for a petroleum production licence made between 30 October

1997 and 27 February 1999 was required to meet the criteria established by

sections 27 and 28 of the Petroleum Act 1940 ; and

(b) no further licence

or approval has been, or will be, granted under subclause (1) in respect

of an application made after 27 February 1999 (but this paragraph does not

affect the renewal of a licence or approval granted in respect of an

application made before that date).

(2) Nothing contained

in Clause 6(1) and (4) hereof (but subject to the provisions of Clause 6(6)

shall constitute a derogation from the rights of the Minister pursuant to

Section 87a(1) of the Petroleum Act, 1940-1971 of the State or prevent

(having regard to the Unit Agreement and practical and economic production of

petroleum) the State from acquiring an interest whether directly or indirectly

in the whole or any part of such licence.

(3) Nothing in this

Indenture contained shall limit any rights of the Producers or any of them

under the Petroleum Act, 1940-1971 of the State or under the terms of any

Petroleum Exploration Licences or Petroleum Production Licences issued or held

from time to time by the Producers or any of them including but not limited to

the rights of renewal under or arising therefrom or to the rights of renewal

under the provisions of the Petroleum Act, 1940-1971 of the State and it

is hereby expressly acknowledged and agreed by the State that the rights of

the Producers under this Indenture or under any Petroleum Production Licences

issued pursuant to this Indenture shall be in addition to and not in

substitution for or in derogation from the rights pertaining to the issue or

holding of Petroleum Production Licences under the Petroleum

Act, 1940-1971 of the State.

(4) Subject to the

provisions of the Petroleum Act, 1940-1971 of the State applying at the

date of this Indenture to Petroleum Exploration Licences Nos. 5 and 6 the

State:

(a) shall ensure that

the terms covenants and conditions (and in particular without prejudice to the

generality of the foregoing the expenditure obligations contained therein or

applicable thereto by virtue of the provisions of the Petroleum

Act, 1940-1971 applying at the date hereof) of Petroleum Exploration

Licences Nos. 5 and 6 (as previously renewed) shall unless otherwise agreed in

writing by such of the Producers as are the holders thereof remain as at the

date thereof until the date of expiry of such licence in each case being the

27th day of February, 1979, and that the State will not by legislation

regulation order or administrative action restrict any rights contained or

provided in the Petroleum Act, 1940-1971 as at present in force to the

renewal thereof.

(b) will not by

legislation regulation order or administrative action restrict or prevent the

Producers from giving effect to their rights and obligations under the Sales

Contracts referred to in Clauses 1(7) (a) and (b) hereof or under any other

Sales Contracts (in so far as they are entered into with an arms length

purchaser) or under the P.A.S.A. Future Requirements Agreement or under any

contract entered into pursuant thereto or under the Unit Agreement (which for

the purposes of this subclause shall be construed as a reference only to the

Unit Agreement in the form approved by the Minister and with such amendments

thereto as have previously been agreed to by the Minister) or any Joint

Operating Agreement in so far as it applies to the Subject Area.

(5) For the purpose of

Section 36 of the Petroleum Act, 1940-1971 of the State the areas

comprised within the Petroleum Production Licences granted pursuant to this

Indenture shall be deemed to be contiguous areas within the meaning of

Section 36(1a) thereof and such areas shall be deemed to be one area for

the purposes of Section 36(3) thereof.

(6) —

(a) Where any

Petroleum Production Licence granted pursuant to the provisions of Clause 6(1)

hereof has with the consent of the Minister been sub-licensed or upon

notification to the Minister has been mortgaged or charged and the Minister

gives to the holder of the licence notice in writing to make good any breach

or contravention of or failure to comply with any term or condition of such

Petroleum Production Licence or any provision of the Petroleum

Act, 1940-1971 of the State or otherwise as specified in the notice then

prior to the taking of any action which could have the effect of suspending or

cancelling any such Petroleum Production Licence the Minister shall cause a

copy of such notice to be forwarded to:

(i)

each sub-licensee to whom the Petroleum Production

Licence has been sub-licensed in accordance with the provisions of

Clause 6(1) (b) hereof; and

(ii)

each assignee mortgagee or chargee to or in favour of

whom any assignment mortgage or charge of the Individual Interest (as defined

in the Unit Agreement) of any Producer has been effected in accordance with

the provisions of Clause 14 hereof whose name and address for service of

notice has previously been notified in writing to the Minister.

(b) If a Petroleum

Production Licence granted pursuant to the provisions of Clause 6(1) hereof is

cancelled by the Minister pursuant to Section 87a of the Petroleum

Act, 1940-1971 of the State the Minister shall forthwith offer to the

licensees of that Petroleum Production Licence (other than the licensee in

default) the grant of a new Petroleum Production Licence in respect to the

same area and upon the same terms and conditions as were applicable to the

Petroleum Production Licence so cancelled, and such new licensees shall be

entitled to and shall grant new sub-licences to all sub-licensees (other than

the licensee and sub-licensee in default) of the Petroleum Production Licence

so cancelled such new sub-licences to be in respect to the same areas and upon

the same terms and conditions as were applicable to the sub-licences derived

from the Petroleum Production Licence so cancelled. In the event that all

licensees of the Petroleum Production Licence are in default then all

sub-licensees (other than the licensees or sub-licensees in default) shall be

entitled to the grant of a new Petroleum Production Licence in respect to the

same area and upon the same terms and conditions as were applicable to the

Petroleum Production Licence so cancelled. The Minister shall be entitled to

require the payment of any royalty properly due in respect to the Petroleum

Production Licence so cancelled as a condition precedent to the grant of any

such new Petroleum Production Licence and further the grant of any such new

Petroleum Production Licence pursuant to this subclause shall not constitute a

waiver of the rights of the Minister against the holders in default under the

Petroleum Production Licence so cancelled.

(7) The rights granted

pursuant to Section 33 of the Petroleum Act, 1940-1971 of the State in

respect to the construction and maintenance upon the land comprised in a

Petroleum Production Licence of such pipelines pumping stations tanks and

roads as are necessary for the fulfilment of the licensees obligations

thereunder shall extend and apply to the construction and maintenance of any

such facilities as are necessary for operations to be conducted under the

Unit Agreement or any Joint Operating Agreement or other applicable agreement

in respect to any area not then comprised in a Petroleum Production Licence

granted pursuant to the provisions of Clause 6(1) hereof.

(8) For the purposes

of Section 80c of the Petroleum Act, 1940-1971 of the State the Minister

hereby approves the applicable provisions of the Unit Agreement as

constituting an approved scheme for the working and developing of any field

which may from time to time be situate in its entirety within the Subject Area

and to which the provisions of Section 80c of the Petroleum

Act, 1940-1971 of the State may apply.

(9) The Producers

shall forthwith notify the Minister of any amendments to the Unit Agreement

subsequent to the execution thereof.

(10) The clauses of

this Indenture, save and except clauses 6(1) and 6(4) hereof, shall apply to

any Petroleum Production Licences granted in respect or for the purposes of

the production of petroleum from the following areas:

Area 1

Commencing at a point being the intersection of latitude 27°00′S

and longitude 140°00′E, thence east to longitude

141°00′E, south to latitude 27°15′S, west to longitude

140°55′E, south to latitude 27°20′S, west to longitude

140°50′E, south to latitude 27°25′S, west to longitude

140°35′E, south to latitude 27°30′S, west to longitude

140°25′E, south to latitude 27°32′S, west to longitude

140°23′E, south to latitude 27°33′S, west to longitude

140°21′E, south to latitude 27°35′S, west to longitude

140°18′E, south to latitude 27°37′S, west to longitude

140°16′E, south to latitude 27°38′S, west to longitude

140°15′E, north to latitude 27°27′S, west to longitude

140°00′E, north to the point of commencement.

Area 2

Commencing at a point being the intersection of latitude 27°37′S

and longitude 139°38′E, thence east to longitude

139°53′E, south to latitude 27°45′S, east to longitude

140°00′E, south to latitude 27°56′S, west to longitude

139°59′E, south to latitude 27°57′S, west to longitude

139°58′E, south to latitude 27°59′S, west to longitude

139°57′E, south to latitude 28°00′S, west to longitude

139°56′E, south to latitude 28°02′S, west to longitude

139°55′E, south to latitude 28°06′S, east to longitude

140°00′E, south to latitude 28°18′S, west to longitude

139°56′E, south to latitude 28°19′S, west to longitude

139°52′E, south to latitude 28°23′S, east to longitude

139°53′E, south to latitude 28°24′S, east to longitude

139°55′E, south to latitude 28°25′S, east to longitude

140°15′E, south to latitude 28°35′S, west to longitude

139°38′E, north to the point of commencement.

being the areas marked "1" and "2" respectively on the plan annexed hereto as

Appendix "D".

7. RATES AND TAXES

(1) Notwithstanding

the provisions of any Act to the contrary all rates taxes imposts and other

charges imposed or levied by the State or by any agency or instrumentality of

the State or any local or other public authority in respect to the land

referred to in Clause 4(1) hereof shall be charged or levied on the assessed

unimproved value thereof.

(2) The State will not

impose nor (in so far as it is competent to do so) permit or authorise any

rates taxes levies imposts or other charges (including rates taxes levies

imposts or other charges in respect to the carriage of goods by road rail or

sea) which discriminates by the manner in which they are levied against the

Producers in their operations pursuant to the Unit Agreement or any Joint

Operating Agreement provided that any variation in the royalty rate under the

Petroleum Act, 1940-1971 is agreed not to be discriminatory merely

because the Producers are the only persons in the State paying such a royalty.

8. SUPERVISORY CONTROL SYSTEMS

Subject to the Petroleum Act, 1940-1971 the State will permit the

Producers to operate wells field facilities gathering systems and trunklines

by remote supervisory control systems.

9. STAMP DUTY

The State agrees that:

(1) this Indenture;

(2) the Unit Agreement

and any cross charge created in connection with the Unit Agreement

contemporaneously with the execution thereof;

(3) the Deed of

Covenant and Release and Deed Supplemental thereto both referred to in Clause

3(1) (a) (ii) hereof;

(4) any initial

instrument in respect to the land referred to in Clause 4(1) hereof executed

for the purpose of implementing or otherwise giving effect to the provisions

of the Unit Agreement as of the date of execution of this Indenture or any

subsequent instrument in respect to the land referred to in Clause 4(1) hereof

executed as a consequence of any adjustment effected pursuant to the

provisions of the Unit Agreement of participating interests thereunder but

excluding any assignment of an Individual Interest not otherwise exempted by

this Clause 9 and excluding any mortgage charge encumbrance or other security

covenant or agreement executed by a Producer for the purpose of the financing

of its obligation under this Indenture and under the Unit Agreement other than

a cross charge exempted by subclause (2) of this Clause 9;

(5) any Petroleum

Production Licence granted pursuant to Clause 6(1) hereof and any sub-licence

granted pursuant to such Petroleum Production Licence;

(6) all agreements and

other documents as may be entered into contemporaneously with execution of the

Unit Agreement relevant to the acquisition of and/or assumption of rights and

obligations by the Commonwealth of Australia of part of Delhi's Individual

Interest (as such expression is defined in the Unit Agreement) and any cross

charge required to be created thereby;

(7) the Deed of

Covenant and Consent dated the 17th May 1974 made between The Australian Gas

Light Company of the first part; Norman Egan Connellan of the second part; the

Producers of the third part and The Pipeline Authority of the fourth part;

(8) any agreement

assurance or other document affecting any amendment (as approved by the

Minister) of the Unit Agreement providing for the inclusion of additional

reserves of petroleum whether inside or outside of the Subject Area and any

other agreement assurance or other document approved by the Treasurer for that

purpose which effects any amendment to the Unit Agreement;

(9) the first of any

Deeds of Assignment to be entered into by Delhi and Total Exploration

Australia Pty. Ltd. providing for the assignment of part of Delhi's Individual

Interest (as such expression is defined in the Unit Agreement) and any other

agreement or other document required to be entered into in respect thereto

pursuant to the provisions of the Unit Agreement and any cross charge required

to be created thereby;

(10) any assignment by

a Producer made within one year of the date of the ratification of this

Indenture of the whole or part of its Individual Interest (as such expression

is defined in the Unit Agreement) in favour of a related company (as such

expression is defined in Section 6(5) of the Companies Act, 1962-1974)

and any agreement or other document required to be entered into with respect

thereto pursuant to the provisions of the Unit Agreement or any cross charge

with respect thereto required to be created thereby

shall be exempt from stamp duty under the laws of the State.

10. AUTHORISATION FOR THE PURPOSES OF THE

TRADE PRACTICES ACT 1974 OF THE COMMONWEALTH

(1) The State

undertakes to use its best endeavours to maintain in force a statutory

authorisation of the following things for the purposes of section 51 of the

Trade Practices Act 1974 of the Commonwealth:

(a) the

authorised agreements; and

(b) anything done

(before or after the commencement of this clause) by a party, or anyone acting

on behalf of a party, under or to give effect to the authorised agreements.

(2) In respect of

other matters relating to the rights and obligations of the Producers, the

State undertakes to give consideration, at the request of the Producers, to

the introduction of legislation specifically authorising the making of

agreements, arrangements and understandings or other things for which the

Producers may want an authorisation under section 51 of the Trade Practices

Act 1974 of the Commonwealth.

11. PROHIBITION UPON PARTITION

No Petroleum Production Licence, sub-licence, title or right granted pursuant

to this Indenture or held for the purpose of or under the provisions of the

Unit Agreement or any Joint Operating Agreement and no real or personal

property and no chattel belonging to owned or used jointly by the Producers or

any of them under or pursuant to the Unit Agreement or any Joint Operating

Agreement shall otherwise than by agreement of the Producers or any of them be

subject to or capable of partition including partition under the Law of

Property Act, 1936-1972 of the State or under any order of any Court of

competent jurisdiction made under that Act or otherwise or be subject to the

making of an order for sale under the said Act.

12. ROYALTY PAYMENT

(1) Payment of Royalty

During the period from 1st January 1991 to 31st December 2000 (both inclusive)

("the Royalty Term") the Producers shall pay royalty calculated in accordance

with this Indenture in respect of petroleum recovered from any area comprised

in a Petroleum Production Licence granted to the Producers or to some one or

more of them within the Subject Area or the areas referred to in Clause 6(10)

of this Indenture and:

(a) supplied to the

Pipelines Authority of South Australia (PASA) under the terms of the Natural

Gas Interim Supply Act 1985; and

(b) sold to PASA or

any other purchaser under the terms of any agreement for the supply of

petroleum whether such agreement is signed before or after the date of

commencement of this Clause

("the petroleum").

(2) Calculation of

Royalty

The Producers shall pay royalty at a rate of ten (10) percentum of the value

at the wellhead of the petroleum, which for the purposes of this Indenture,

shall be an amount calculated by taking the gross sales value of the petroleum

as defined in sub-clause (3) (a) (i) and subtracting therefrom the following

sums:

(a) a sum calculated

by writing off on a straight line basis and with no interest component, over a

period of ten (10) years commencing from 1st January 1991, the sum of EIGHT

HUNDRED MILLION DOLLARS ($800,000,000.00) being the deemed capital value of

existing plant of the Producers or some one or more of them;

(b) a sum calculated

by writing off on a straight line basis together with interest on the written

down value at the rate provided by sub-clause (3) (c) of this clause, over a

period of ten (10) years commencing from the month the expense was incurred

(or such lesser period as may be agreed between the Producers and the Minister

as being the life of the field) the actual capital expenditure incurred after

1st January 1991 by the Producers or some one or more of them in respect of

all plant used for the purposes of treating, processing or refining of the

petroleum prior to delivery (but not upstream of the wellhead) or in conveying

the petroleum to the point of delivery to the purchaser PROVIDED HOWEVER that

if any item of such plant is sold prior to being fully depreciated, the amount

obtained upon such sale shall be deducted from the written down value of such

item for the purposes of calculating the deduction, but not so as to reduce

the written down value below zero;

(c) a sum, calculated

on a basis to be agreed between the Producers and the Minister, or if

agreement is not reached within 90 days of the commencement of this Clause, a

sum calculated on a basis determined by the Minister, being expenditure

actually incurred by the Producers or some one or more of them in respect of

persons not employed on site in the Subject Area or the areas referred to in

Clause 6(10) of this Indenture but whose employment functions directly relate

to treating, processing or refining of the petroleum prior to delivery (but

not upstream of the wellhead) or in conveying the petroleum to the point of

delivery to the purchaser;

(d) a sum being

expenditure (other than expenditure upstream of the wellhead) actually

incurred by the Producers or some one or more of them in respect of operating

costs related to treating, processing or refining of the petroleum prior to

delivery or in conveying the petroleum to the point of delivery to the

purchaser, including but not limited to the amount of any licence fees payable

in respect of any pipeline licence, all wharfage dues and Commonwealth

petroleum taxes PROVIDED HOWEVER that:

(i)

the amount of such deduction will be reduced by the

amount obtained upon the sale of any item of plant which has not been

depreciated or which has been fully depreciated, but not so as to reduce the

deduction below zero,

(ii)

if any such expenditure is incurred pursuant to any

agreement which is not in the Minister's opinion bona fide or arms length,

such expenditure (or part thereof) may not be deducted except with the

Minister's prior written approval, and

(iii)

any expenditure allowed as a deduction under this

sub-clause shall not include any expenditure provided for in sub-clause2 (b)

or 2 (c) or 2 (e) of this Clause;

(e) a sum being

expenditure (other than expenditure upstream of the wellhead) actually

incurred by the Producers or some one or more of them pursuant to a bona fide

arms length agreement to lease any plant used for the purposes of treating,

processing or refining of the petroleum prior to delivery or in conveying the

petroleum to the point of delivery to the purchaser PROVIDED HOWEVER THAT:

(i)

any such expenditure in any one calendar year which is in

excess of:

(A) in the calendar year 1991—the sum

of $4 million; or

(B) in all subsequent calendar years, the

sum of $4 million increased by the same percentage as the percentage increase

in the Consumer Price Index (All Groups) for the City of Adelaide ("CPI") from

the CPI in the calendar year 1991 to the CPI in the relevant year

shall not be deductible without the written approval of the Minister;

(ii)

any expenditure (or part thereof) incurred under an

agreement which in the Minister's opinion is not bona fide or arms length may

be deducted with the Minister's written approval; and

(f) a sum being the

actual expenditure (other than expenditure upstream of the wellhead) incurred

by the Producers or some one or more of them in rehabilitating the ground

surface and site of plant and the actual expenditure incurred in dismantling

removing or abandoning of such plant less any salvage obtained thereon where

such plant is used for the purposes of treating processing or refining of the

petroleum prior to delivery or in conveying the petroleum to the point of

delivery to the purchaser and the actual expenditure incurred in

rehabilitating the ground surface and site of a well of the type described in

sub-clause (3) (b) and the actual expenditure incurred in abandoning such well

but not including any costs incurred as a result of the loss of control of any

well.

(3) Further provisions

regarding calculation of Royalty

(a) For the purposes

of sub-clause (2):

(i)

in each month the gross sales value of the petroleum

means:

(A) the value of the actual sales in

respect of the petroleum described in sub-clause (1) (a) in that month; plus

(B) the value of the actual sales in

respect of the petroleum described in sub-clause (1) (b) in that month

PROVIDED HOWEVER that if any petroleum is not in the Minister's opinion

supplied to a bona fide arms length purchaser and in the Minister's opinion

not sold for full market value, the gross sales value of such petroleum shall

be the amount which would have been received in respect of such petroleum from

a bona fide arms length purchaser for full market value;

(ii)

the term "plant" includes but is not limited to:

(A) any machinery, equipment, vehicle,

implement, tool, article, vessel, pit, building, structure, improvement or

other such property used in, or in connection with, treating processing or

refining of the petroleum prior to the delivery or in conveying the petroleum

to the point of delivery to the purchaser; or

(B) any pipeline;

and

(iii)

"wellhead" means the casing head and includes any casing

hanger or spool, or tubing hanger, and any flow control equipment up to and

including the wing valves.

(b) Non Producing

Wells

The capital expenditure referred to in sub-clause (2) (b) may include the

actual capital expenditure incurred by the Producers or some one or more of

them in respect of wells used solely for the purpose of assisting or enhancing

the recovery of the petroleum from other wells or for the purposes of storing

the petroleum or for the recovery or disposal of water used in connection with

treating processing or refining of the petroleum prior to delivery or for any

similar purpose other than the production of the petroleum and may also

include the actual capital expenditure incurred by the Producers or some one

or more of them in converting a well used for the production of the petroleum

to a well used for such other purposes.

(c) Interest Rate

For the purposes of sub-clause (2) (b) the interest rate shall be one half of

the long term Australian Government Bond Rate for bonds of a 10 year term as

published at the end of the month in which the capital expenditure was made.

If no such rate is in existence or published at the end of such period then,

unless the parties otherwise agree, the interest rate for the purposes of

sub-clause (2) (b) shall be one half of the average of the long term

Australian Government Bond Rate for bonds of a 10 year term prevailing during

the period of 5 years preceding the date on which such rate ceased to exist or

be published.

(d) Apportionment of

Expenses

Where an item of plant is used partly for the purposes of treating, processing

or refining of petroleum prior to delivery or in conveying petroleum to the

point of delivery to the purchaser, and partly for some other purpose, the

amount of the deduction (whether for capital or operating expenditure) which

shall be allowed shall be a proportion only of the actual capital or operating

expenditure. The apportionment of the actual expenditure shall be made upon

the basis agreed between the Producers and the Minister or, in the event that

agreement is not reached within 90 days of the commencement of discussions

entered into with a view to reaching such agreement, upon the basis determined

by the Minister.

(e) Sale of Plant

Notwithstanding the provisions of sub-clause (2), if an item of plant is sold

by a Producer ("the first Producer") to another Producer, or to a company that

becomes a successor or assign of the first Producer under this Indenture ("the

second Producer"), the second Producer may only depreciate the plant to the

extent to which the first Producer was, immediately before the time of sale,

entitled to depreciate the plant under this Indenture.

(f) Take or Pay

(i)

For the purposes of this clause and of calculating the

gross sales value of the petroleum, where the Producers or any one or more of

them enter into an agreement commonly known as a take or pay agreement, any

payment received by the Producers or any one or more of them in respect of

petroleum which has been paid for but not been taken shall be treated as part

of the gross sales value of the petroleum at the time of receipt of payment by

such Producer or Producers and not at any other time.

(ii)

The Producers will, on or before 15th June 1991, pay to

the Minister the sum of ONE MILLION ONE HUNDRED AND FIFTY FOUR THOUSAND SEVEN

HUNDRED AND EIGHTY SIX DOLLARS ($1,154,786.00) being the royalty payable on

petroleum paid for but not taken under any such take or pay arrangements up to

and including 31st December 1990.

(g) Tolling

(i)

If the Producers or any one or more of them receive any

revenue from the use of any plant downstream of the wellhead used for treating

processing or refining petroleum sourced from anywhere within the area from

time to time comprised in Petroleum Exploration Licences 5 and 6 or any

Petroleum Production Licence issued from an area which was comprised in

Petroleum Exploration Licences 5 and 6 immediately prior to the time such

Petroleum Production Licence was issued, or in conveying such petroleum to the

point of delivery to the purchaser (such plant to include but not be limited

to part or all of each of the plant at Moomba, South Australia, the plant at

Port Bonython in the said State or the pipeline the subject of Pipeline

Licence 2) such revenue shall be deemed to be part of the gross sales value of

the petroleum to the intent that royalty shall be payable thereon.

(ii)

Any sums, being sums deemed under sub-clause (3) (g) (i)

to be part of the gross sales value of the petroleum, paid by the Producers or

any one or more of them in respect of the use of such plant for treating

processing or refining such petroleum or in conveying such petroleum to the

point of delivery to the purchaser shall be deemed to be an expense under

sub-clause (2) (d) .

(iii)

If any such plant is used for treating processing or

refining of petroleum sourced from outside of the areas referred to in

sub-clause (3) (g) (i) or in conveying such petroleum to the point of

delivery to the purchaser any amounts which may be claimed as deductions under

this clause (whether such deductions be by way of operating expenditure or

capital expenditure) in respect of such plant shall be reduced by the

proportion which would be obtained by the method of apportioning costs used by

the Producers to ascertain the tolling fee, or on such other basis as the

Minister approves, but any revenue received by the Producers or any one or

more of them for the use of such plant for the treating processing or refining

of such petroleum prior to delivery or in conveying the petroleum to the point

of delivery to the purchaser shall not be deemed to be part of the gross sales

value of the petroleum.

(h) Licence Fees

Any fees paid by the Producers or any one or more of them in respect of any

Petroleum Production Licences granted within the Subject Area or the areas

referred to in Clause 6(10) of this Indenture may be set off against the

amount of royalty payable under this Indenture.

(4) Royalty Returns

(a) Not later than

thirty (30) days after the conclusion of each calendar month during the

Royalty Term, the party appointed from time to time as Operator under the

Unit Agreement ("the Operator") will calculate and notify to the Minister the

royalty, calculated by taking the gross sales value of the petroleum sold in

that month, and deducting therefrom the estimated monthly expenditure

described in sub-clause (4) (c) , payable by each Producer. The Operator shall

with each such notification provide the Minister with a statement, in a form

approved by the Minister, advising of the quantity of the petroleum sold and

the amount realised upon such sale during the last preceding month, together

with such other information as the Minister may require.

(b) Each Producer

shall not later than thirty (30) days after the conclusion of each calendar

month during the Royalty Term pay to the Minister the amount of royalty

specified in the notice referred to in sub-clause (4) (a) as payable by that

Producer.

(c) On or before each

15th April (in respect of the next succeeding six (6) month period commencing

1st July) and on or before each 15th October (in respect of the next

succeeding six (6) month period commencing 1st January) during the Royalty

Term, the Operator shall bona fide estimate the gross sales value of the

petroleum, the allowable deductions and hence calculate the estimated royalty

payable for the next succeeding six (6) month period and shall provide the

Minister with such estimates, together with the apportionment thereof on a

monthly basis. The Operator shall provide such estimate in respect of the

period commencing 1st January 1991 and concluding 30th June 1991, within 30

days of the enactment of the Cooper Basin (Ratification) (Royalty) Amendment

Act 1991.

(d) Not later than

thirty (30) days after the completion of each twelve month period during the

Royalty Term concluding on each 30th June the Operator shall reconcile the

monthly sales and estimated expenditure with the actual sales and expenditure

and reconcile all calculations of royalties and shall provide the Minister

within the said period of 30 days with copies of such reconciliations,

together with a notice advising the Minister of any additional royalty

calculated in accordance with the reconciliations as payable by each Producer.

If any such reconciliation shows that the total of the amounts of royalty paid

during the last preceding 12 months was in excess of the amount of royalty

which should have been paid for that period, the difference shall, subject to

this sub-clause, be set off against royalty payable in the next succeeding

months. The Operator shall provide such reconciliation in respect of the

period commencing 1st January 1991 and concluding 30th June 1991 on or before

30th July 1991.

(e) Each Producer

shall not later than thirty (30) days after the completion of each twelve

month period during the Royalty Term concluding on each 30th June pay to the

Minister the additional royalty calculated in accordance with the

reconciliation referred to in sub-clause 4 (d) as payable by that Producer.

(f) The Minister shall

not be concerned to inquire that the royalty has been correctly apportioned as

between each of the Producers so long as the aggregate of the royalty so

apportioned equals the total amount of royalty payable in accordance with this

Clause. The Producers may, however, dispute inter se the correctness of the

apportionment of royalty.

(g) Provided that

royalty has been correctly calculated, each Producer shall only be liable to

pay the amount of royalty specified in each royalty return as payable by that

Producer. Nothing in this Clause shall confer joint or joint and several

liability on the Producers for the payment of royalty.

(h) The Producers

shall at their cost cause the royalty calculation reconciliations submitted by

the Operator to be audited by the auditor appointed by the Operator to audit

its own accounts (provided that such auditor must be a duly registered auditor

in Australia) and the Operator shall forward a copy of the auditor's report in

respect of a particular reconciliation within 3 months of the receipt of such

reconciliation by the Minister, such report to be accompanied by a certificate

by the auditor that the reconciliation is in accordance with the royalty

provisions of this Indenture.

(i) If the Minister

considers that any matter has been incorrectly calculated in any royalty

return, the Minister may recalculate such return and by notice in writing to

the Operator within 6 calendar months of the receipt by the Minister of the

audit of the relevant royalty return require the Producers to pay within 30

days of the date of such notice the additional royalty calculated by the

Minister as payable and in any proceedings before a Court for the review of

such determination, the Minister's recalculation shall be deemed to be correct

unless the contrary is proved.

(j) Either the

Producers or the Minister may, notwithstanding the audit of a royalty return,

within a period of 5 years of the Minister's receipt of that return, serve

notice on the other party seeking to correct an inaccuracy in that return. If

the notice is served by the Producers, the Minister may within 90 days of the

receipt of the Producers' notice make a determination as to the correctness of

the Producers' notice.

(k) The Producers or

any one of them shall at the request of the Minister or of any person duly

authorised in writing by the Minister produce to the Minister or such

authorised person such books, accounts and other records (including but not

limited to computer records) in the possession or power of that Producer

relating to the petroleum and the royalty payable thereon and shall permit the

Minister or such authorised person to inspect and make copies of such books,

accounts and records.

(l) The Minister may

require the Operator to prepare and provide to the Minister forecasts of

royalty for such periods and to be provided at such times as the Minister may

reasonably specify.

(m) If the Producers

fail to pay any payment of royalty within the time provided by this

sub-clause, the Producers shall pay interest on the amount of royalty which

should have been paid, calculated on a daily basis from the date such payment

should have been made to the date of actual payment, at a rate being the sum

of 2% per annum and the long term Australian Government Bond Rate for bonds of

a 10 year term as published at the end of the month the payment should have

been made. If the long term Australian Government Bond Rate for bonds of a 10

year term ceases to exist or be published then the rate of interest shall be

the sum of 2% per annum and the average of the long term Australian Government

Bond Rate for bonds of a 10 year term prevailing during the period of 5 years

preceding the date on which such rate ceased to exist or be published.

(5) General

(a) The payment of

royalty pursuant to this Indenture shall during the Royalty Term be in

substitution for and not in addition to any royalty which would otherwise have

been payable under the Petroleum Act, 1940 in respect of the petroleum.

(b) On and from the

1st day of January 2001 the Producers shall pay royalty in accordance with the

provisions of the Petroleum Act, 1940 or any statute repealing,

replacing, amending or consolidating that Act.

(c) Notwithstanding

anything to the contrary contained in this Indenture no royalty, tax, impost

or levy of whatsoever nature or kind other than bona fide charges for services

provided by the State shall be payable by the Producers upon any petroleum

produced from a State other than South Australia.

(d) The Minister may

delegate any of his powers contained in this Clause 12; however such

delegation shall not derogate from the Minister's ability to exercise such

power personally.

(e) In making any

determination under this Clause, the Minister must take into consideration all

relevant factors and make the determination on reasonable grounds.

(f) In determining the

value of actual sales of petroleum, the full market value of petroleum, or the

amount of any expenditure for the purposes of this clause, any GST component

is to be ignored.

13. PIPELINES

Subject to the Minister's approval and to the Australian Government having

agreed to make available adequate finance for that purpose upon terms and

conditions satisfactory to the State the State will construct or cause to be

constructed and maintained between Moomba and the site of any future

petrochemical industry such pipelines and ancillary meters regulators

compressors pipes communication links and other facilities as are adequate to

ensure the delivery of natural gas petrochemical feedstocks and other liquid

hydrocarbons to be sold and delivered in pursuance of the provisions of the

Sales Contracts referred to in Clause 1(7) (b) and (c) hereof.

14. ASSIGNMENT

(1) A Producer shall

not assign any right power benefit or privilege conferred by this Indenture

except as provided hereunder.

(2) Subject to the

provisions of the Unit Agreement and as applicable the provisions of any

relevant Joint Operating Agreement, any Producer may:—

(a) assign subject to

Section 42 of the Petroleum Act, 1940-1971 as at present in force of the

State to any person:

(i)

the rights powers or privileges conferred on such

Producer by this Indenture; and together with

(ii)

the right or interest of such Producer in any sub-licence

created out of any Petroleum Production Licence granted pursuant to this

Indenture; and together with

(iii)

the obligations or duties imposed on such Producer under

this Indenture.

(b) mortgage charge

encumber or create a security over all or any part of its interest in any

Petroleum Production Licence, sub-licence, grant or title acquired by such

Producer pursuant to this Indenture and any other rights interests powers or

privileges acquired hereunder. A mortgagee chargee or encumbrancee in

enforcing its security or any receiver or manager of a Producer or any

transferee or assignee thereof shall have the same rights powers and

privileges as such Producer and may exercise the same upon the same terms and

conditions as such Producer or its assigns is entitled to the exercise

thereof.

15. VARIATIONS

Any of the provisions of this Indenture may from time to time be cancelled

added to varied or replaced by agreement but no such cancellation addition

variation or replacement shall take effect until the same has been ratified by

the Parliament of the State.

16. FORCE MAJEURE

(1) The time for

performance of obligations under or arising out of this Indenture (other than

the payment of money) which performance is delayed by circumstances beyond the

reasonable control of the party responsible for the performance including

delays caused by or arising from act of God act of war (declared or

undeclared) earthquake explosions act of public enemies floods washaways

strikes lockouts stoppages bans or other industrial disturbances interruption

of supplies breakdowns restraint of labour partial or entire failure of

petroleum reserves or other similar circumstances may be extended by the

period of the delay and no party shall be liable in damages or otherwise to

any other party by reason of such delay.

(2) The party subject

to the delay shall do all such things as may be necessary in order to overcome

the delay as soon as possible (except for the settlement of disputes on terms

which are not acceptable to such party or of the drilling of wells or the

installation of facilities which are uneconomic) and such party shall as soon

as reasonably practicable notify the other parties when the delay has been

overcome.

17. NOTICES

Any notice or consent or other writing authorised or required by this

Indenture to be given or sent shall be deemed to have been duly given or sent

by the State if signed by the Minister or by persons authorised by the

Minister served personally or forwarded by pre-paid registered post or sent by

telegram telex or cable to the Producers at the following addresses (which may

be altered by notice in writing from time to time):—

|

The General Manager |

Telex: 31955 |

|

The General Manager |

Telex: 21197 |

|

The General Manager |

Telex: 41848 |

|

The Vice President |

Telex: 82215 |

|

The Executive Director |

Telex: 21119 |

|

The Executive Director |

Telex: 21119 |

|

The General Manager |

Telex: 31595 |

|

The Managing Director |

Telex: 82716 |

and by the Producers if signed on behalf of each of the Producers by the

Managing Director a General Manager Vice President Acting Managing Director

Acting General Manager or Secretary of the company served personally or

forwarded by prepaid registered post or sent by telegram telex or cable to the

Minister and any such notice consent or writing which is posted shall be

deemed to have been duly given or sent on the third day after the date of

posting. Notices or consents or writings sent by telegram telex or cable shall

be deemed given on the day after the day they are dispatched.

18. GOVERNING LAW

This Indenture shall be governed by and construed in accordance with the law

for the time being of the State of South Australia and (subject to the

provisions of Clause 19) the parties hereto hereby consent and submit to the

jurisdiction of the Courts of such State and to all courts having jurisdiction

to hear appeals therefrom.

19. ARBITRATION

In respect to:

(a) the Unit Agreement

and any other agreement relating to the rights and obligations of the

Producers as between themselves under the Unit Agreement;

(b) the Sales

Contracts; the Exploration Indenture; the P.A.S.A. Future Requirements

Agreement and any contracts entered into pursuant to the P.A.S.A. Future

Requirements Agreement;

(c) the matters

referred to in Clause 10(2) hereof;

the provisions of Section 24a(1) of the Arbitration Act, 1891-1974 shall

not apply and any question difference dispute or disagreement referred to

arbitration shall be and be deemed to be a submission to arbitration within

the meaning of the Arbitration Act, 1891-1934 of the State.

20. RELATIONSHIP OF PRODUCERS

The rights duties and obligations of the Producers under this Indenture shall

be several and not joint nor joint and several save that the rights duties and

obligations imposed upon the Producers in respect to the conduct of operations

under the provisions of the Petroleum Act, 1940-1971 of the State in

respect to any Petroleum Production Licence granted pursuant to the provisions

of this Indenture shall as between the holders thereof be joint and several.

21. ENVIRONMENTAL PROTECTION

Notwithstanding any other provision of this Indenture it is hereby recognised

and agreed by the Producers that they shall in conducting operations

contemplated pursuant to the provisions of this Indenture at all times comply

with the laws of the State for the protection of the environment.

APPENDIX "A"

APPENDIX "B"

SOUTH AUSTRALIA—PETROLEUM ACT, 1940-1971

PETROLEUM PRODUCTION LICENCE NUMBER

I, HUGH RICHARD HUDSON, Minister of Mines and Energy in the State of South

Australia pursuant to the Petroleum Act, 1940-1971 and the Cooper Basin

(Ratification) Act, 1975 and all other enabling powers HEREBY GRANT

jointly to SANTOS LIMITED of 183 Melbourne Street, North Adelaide DELHI

INTERNATIONAL OIL CORPORATION of 33 King William Street, Adelaide VAMGAS NO

LIABILITY of 151 Flinders Street, Melbourne and (Block Owners) of

a

Petroleum Production Licence in respect of the area described

hereunder:—

DESCRIPTION OF AREA

TERMS AND CONDITIONS

1. The term of this

licence is thirty one years commencing on and inclusive of the First day of

January 1975 with the right, subject to carrying out adequately the

obligations of the licence, to renewal from time to time on the same terms and

conditions for further terms of twenty one years.

2. The licensees

hereby covenant with the Minister that they will make payment of the yearly

rent provided under the Petroleum Act, 1940-1971 and of the royalty

referred to in the Cooper Basin (Ratification) Act, 1975 and will subject

to the provisions of the Cooper Basin (Ratification) Act, 1975 comply

with the provisions of the Petroleum Act, 1940-1971 and amendments

thereto and with all Regulations for the time being in force under that Act

and with any directions given by the Minister the Director of Mines or any

other person pursuant to that Act or the said Regulations.

3. The Minister hereby

gives and records his consent to the grant by the Licensees of a Sub-Licence

pursuant to the provisions of the Cooper Basin (Ratification) Act, 1975

in the form of or to the effect set out in the Schedule hereto.

Signed, Sealed and Delivered by the said Minister of Mines and Energy at

ADELAIDE this

day of

1975.

Signed, Sealed and Delivered by the said Licensees at ADELAIDE this

day of

1975.

THE SCHEDULE HEREINBEFORE REFERRED TO

THIS DEED OF SUB-LICENCE made the

day of

1976

BETWEEN:

SANTOS LIMITED whose registered office is situated at 183 Melbourne Street,

North Adelaide in the State of South Australia (hereinafter sometimes called

"Santos" which expression where the context requires or permits shall include

its successors and assigns)

AND

DELHI INTERNATIONAL OIL CORPORATION whose principal office in Australia is

situated at 33 King William Street, Adelaide aforesaid (hereinafter sometimes

called "Delhi" which expression where the context requires or permits shall

include its successors and assigns)

AND

VAMGAS NO LIABILITY whose registered office is situated at 20 Bridge Street,

Sydney in the State of New South Wales (hereinafter sometimes called "Vamgas"

which expression where the context requires or permits shall include its

successors and assigns)

AND

(Block Owners)

(the said companies being hereinafter collectively called "the Licensors"

which expression where the context requires or permits shall include their

respective successors and assigns)

OF THE ONE PART

AND

(the parties from time to time to the Unit Agreement)

(the said companies being hereinafter collectively called "the Licensees"

which expression shall include their respective successors and assigns)

OF THE OTHER PART

WHEREAS:

A. The Licensors are

the joint holders of Petroleum Production Licence No. granted by the Minister

of Mines and Energy for the State of South Australia pursuant to the powers in

the Petroleum Act, 1940-1971 and the Cooper Basin (Ratification)

Act, 1975 over certain land in the State of South Australia as more

particularly described in the said Petroleum Production Licence No.

B. The Licensees have

entered into an agreement made as of the 1st day of January, 1975 known as the

South Australian Cooper Basin Unit Agreement (hereinafter and as the same may

be amended from time to time referred to as "the Unit Agreement") relating

inter alia to the development and production of petroleum from that

sub-surface portion of the area comprised in the said Petroleum Production

Licence No. as the

same is more particularly described in the Schedule hereto.

C. The Licensors with

the consent of the Minister of Mines and Energy of the State of South

Australia have agreed to grant and the Licensees have agreed to accept a

sub-licence to exercise the rights specified in Clause 1 hereof upon the

conditions specified in Clauses 2, 3, 4 and 5 hereof.

NOW THIS DEED WITNESSETH AS FOLLOWS:

1. The Licensors with

the consent of the Minister of Mines and Energy of the State of South

Australia hereby grant to each of the Licensees severally the exclusive right

for a period of thirty-one (31) years commencing and inclusive of the first

day of January, 1975 (with the right of renewal hereinafter contained) subject

to the provisions of this Deed of Sub-Licence to:

(a) conduct operations

for the appraisal and production of petroleum from such sub-surface portion of

the area comprised in the said Petroleum Production Licence

No. as is more

particularly described in the Schedule hereto (hereinafter referred to as "The

Unitized Zone") and subject to Clause 2 hereof to own all petroleum extracted

or released therefrom; and

(b) construct and

maintain upon the land comprised in the said Petroleum Production Licence

No. all such

facilities as the Licensors are entitled to construct and maintain thereon

pursuant to Section 33 of the Petroleum Act, 1940-1971 or the

Cooper Basin (Ratification) Act, 1975 (or both) of the State of South

Australia and as are necessary from time to time for the full enjoyment of the

rights granted pursuant to Clause 1 (a) hereof.

2. Each of the

Licensees hereby expressly acknowledges covenants and agrees with the

Licensors and with each of the other Licensees that in the exercise of

exclusive rights granted pursuant to Clause 1 hereof each Licensee shall at

all times act subject to and in accordance with the provisions of the

Unit Agreement (and in particular to the provisions of Clause 13.01 thereof

which refers to an overriding royalty in favour of Santos) and that such

rights shall entitle each Licensee to extract or release from the Unitized

Zone so much of the petroleum within the Unitized Zone as such Licensee is

entitled to from time to time in accordance with its Gas Unit Participation,

Ethane Unit Participation, Propane Unit Participation, Butane Unit

Participation, Pentanes Plus Unit Participation and its Additional Plant

Products Unit Participation or Participations in accordance with the

provisions of the Unit Agreement.

3. The Licensees

hereby jointly and severally covenant with the Licensors that they will make

payment in accordance with the Unit Agreement of the royalty referred to in

the Cooper Basin (Ratification) Act, 1975 in respect to the production

referred to in Clause 2 hereof and subject to the provisions of the

Cooper Basin (Ratification) Act, 1975 make payment in accordance with the

Unit Agreement of the yearly rent provided under the said Petroleum

Act, 1940-1971 and will subject as aforesaid comply with the provisions

of the said Petroleum Act, 1940-1971 and amendments thereto and with all

Regulations for the time being in force under that Act and with any directions

given by the Minister, the Director of Mines or any other person pursuant to

that Act or the said Regulations and the Licensees hereby further jointly and

severally covenant with the Licensors not to do any act or thing or make any

omission which would cause the Licensors to be in breach or default of the

provisions of the said Petroleum Production Licence

No. or of the provisions of the said Petroleum

Act, 1940-1971 and amendments thereto or of any Regulation for the time

being in force under that Act or with any direction given by the Minister, the

Director of Mines or any other person pursuant to that Act or the said

Regulations.

4. Subject to the due

compliance by the Licensees with their obligations under this Deed of

Sub-Licence the Licensors hereby covenant with the Licensees:

(a) to perform the

covenants and obligations on the part of the Licensors contained in the said

Petroleum Production Licence

No. ;

(b) that for such

period as the same is required for the purpose of the Unit Agreement to

exercise their rights of renewal pertaining to the said Petroleum Production

Licence No. ; and

(c) to renew the

provisions of this Deed of Sub-Licence on the same terms and conditions during

any renewed term of the said Petroleum Production Licence

No. for such

period as aforesaid.

5. The rights of the

Licensees or of any of them granted pursuant to the foregoing provisions of