Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts(1) If the foreign company is a * foreign life insurance company or a * foreign general insurance company, work out its * active foreign business asset percentage according to section 768 - 510, but with the modifications set out in subsections (2) and (3).

(2) Treat a reference in the following provisions to a period as a reference to a * statutory accounting period of the foreign company:

(a) paragraphs 768 - 510(3)(b) and (c);

(b) section 768 - 525.

(3) Apply the modifications set out in the following table.

Modifications for foreign life insurance companies and foreign general insurance companies | ||

Item | The result of this step: | is increased by the amount applicable under subsection (4) for this statutory accounting period: |

1 | step 2 of the method statement in subsection 768 - 520(1) | the most recent * statutory accounting period of the foreign company ending at or before the time mentioned in that step |

2 | step 1 of the method statement in subsection 768 - 525(3) | the * statutory accounting period mentioned in that step (as modified by subsection (2) of this section) |

3 | step 2 of the method statement in subsection 768 - 525(3) | the * statutory accounting period mentioned in that step (as modified by subsection (2) of this section) |

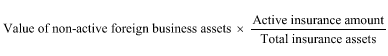

(4) The amount applicable under this subsection for a * statutory accounting period of the foreign company is worked out using the following formula:

where:

"active insurance amount means" :

(a) if the foreign company is a * foreign life insurance company--the untainted policy liabilities (within the meaning of subsection 446(2) of the Income Tax Assessment Act 1936 ) of the foreign company for the statutory accounting period; or

(b) if the foreign company is a * foreign general insurance company--the active general insurance amount worked out under subsection (5) for the statutory accounting period.

"total insurance assets" means:

(a) if the foreign company is a * foreign life insurance company--the total assets (within the meaning of subsection 446(2) of the Income Tax Assessment Act 1936 ) of the foreign company for the statutory accounting period; or

(b) if the foreign company is a * foreign general insurance company--the total assets (within the meaning of subsection 446(4) of that Act) of the foreign company for the statutory accounting period.

"value of non-active foreign business assets" means:

(a) for the purposes of item 1 of the table in subsection (3)--the difference between:

(i) the result of step 1 of the method statement in subsection 768 - 520(1); and

(ii) the result of step 2 of that method statement (apart from this section); or

(b) for the purposes of item 2 of the table in subsection (3)--the difference between:

(i) the result of step 1 of the method statement in subsection 768 - 525(2); and

(ii) the result of step 1 of the method statement in subsection 768 - 525(3) (apart from this section); or

(c) for the purposes of item 3 of the table in subsection (3)--the difference between:

(i) the result of step 2 of the method statement in subsection 768 - 525(2); and

(ii) the result of step 2 of the method statement in subsection 768 - 525(3) (apart from this section).

Active insurance amount for foreign general insurance company

(5) The active general insurance amount under this subsection for a * statutory accounting period of the foreign company is worked out using the following formula:

![]()

where:

"net assets" means the net assets (within the meaning of subsection 446(4) of the Income Tax Assessment Act 1936 ) of the foreign company for the statutory accounting period.

"solvency amount" means the solvency amount (within the meaning of subsection 446(4) of the Income Tax Assessment Act 1936 ) of the foreign company for the statutory accounting period.

"tainted outstanding claims" means the tainted outstanding claims (within the meaning of subsection 446(4) of the Income Tax Assessment Act 1936 ) of the foreign company for the statutory accounting period.

"total general insurance assets" means the total assets (within the meaning of subsection 446(4) of the Income Tax Assessment Act 1936 ) of the foreign company for the statutory accounting period.