Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts(1) If:

(a) an income stream is an asset - tested income stream (long term) to which this Subdivision applies; and

(b) the income stream is an allocated pension within the meaning of the Superannuation Industry (Supervision) Regulations 1994 ; and

(c) one or more payments have been, or are to be, made under the income stream in respect of a period (the payment period ) that:

(i) consists of the whole or a part of a financial year; and

(ii) begins on or after the income stream's commencement day; and

(d) on a day in the payment period, the amount worked out using the formula in subsection (2) is less than the amount worked out using the formula in subsection (3);

the annual rate of ordinary income of a person from the income stream on that day is worked out under subsection (3).

Annual rate based on total payments

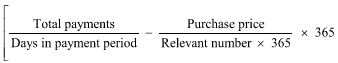

(2) For the purposes of paragraph (1)(d), the formula in this subsection is:

where:

"purchase price" has the meaning given by subsection 9(1).

"relevant number" has the meaning given by subsection 9(1).

"total payments" means the payment, or the total of the payments, made, or to be made, under the income stream in respect of the payment period.

Annual rate based on minimum amount

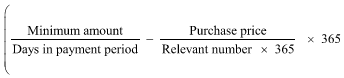

(3) For the purposes of paragraph (1)(d), the formula in this subsection is:

where:

"minimum amount" means the minimum amount calculated in accordance with the method determined, by legislative instrument, by the Minister for the purposes of this definition.

"purchase price" has the meaning given by subsection 9(1).

"relevant number" has the meaning given by subsection 9(1).

Exception--income stream's commencement day happens in June

(4) If:

(a) the income stream's commencement day happens in June; and

(b) no payment is made under the income stream for the financial year in which the commencement day happens;

subsections (2) and (3) do not apply in working out the annual rate of ordinary income of the person from the income stream on a day in that financial year.