Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated ActsIf, in the income year:

(a) the amount worked out under step 4 of the method statement in section 86 - 20 is greater than zero; and

Note: This happens if the entity has entity maintenance deductions that form some or all of the reduction under section 86 - 20.

(b) the * ordinary income or * statutory income of the * personal services entity includes another individual's * personal services income (as well as your personal services income); and

(c) the other individual's personal services income is included in the other individual's assessable income under section 86 - 15;

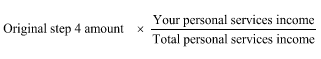

the amount worked out under step 4 is taken to be:

where:

"original step 4 amount" is the amount that would be the amount worked out under step 4 if this section did not apply.

"total personal services income" is the sum of all the amounts of personal services income (whether your personal services income or someone else's) that are included in the personal services entity's ordinary income or statutory income for the income year.

"your personal services income" is the sum of all the amounts of your personal services income that are included in the personal services entity's ordinary income or statutory income for the income year.

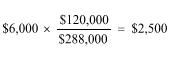

Example: Continuing example 2 in section 86 - 20: Assume that Robyn, another computer consultant, joined NewIT, and NewIT's ordinary income from providing the services also includes Robyn's personal services income of $168,000.

Because NewIT now receives the personal services income of someone else, Ron's step 4 amount is reduced as follows:

Under step 5 of the method statement in section 86 - 20, the amount of the reduction under that section is therefore $52,500, and the amount included in Ron's assessable income is $67,500.